IPO

There is currently no IPO.

Important Notes

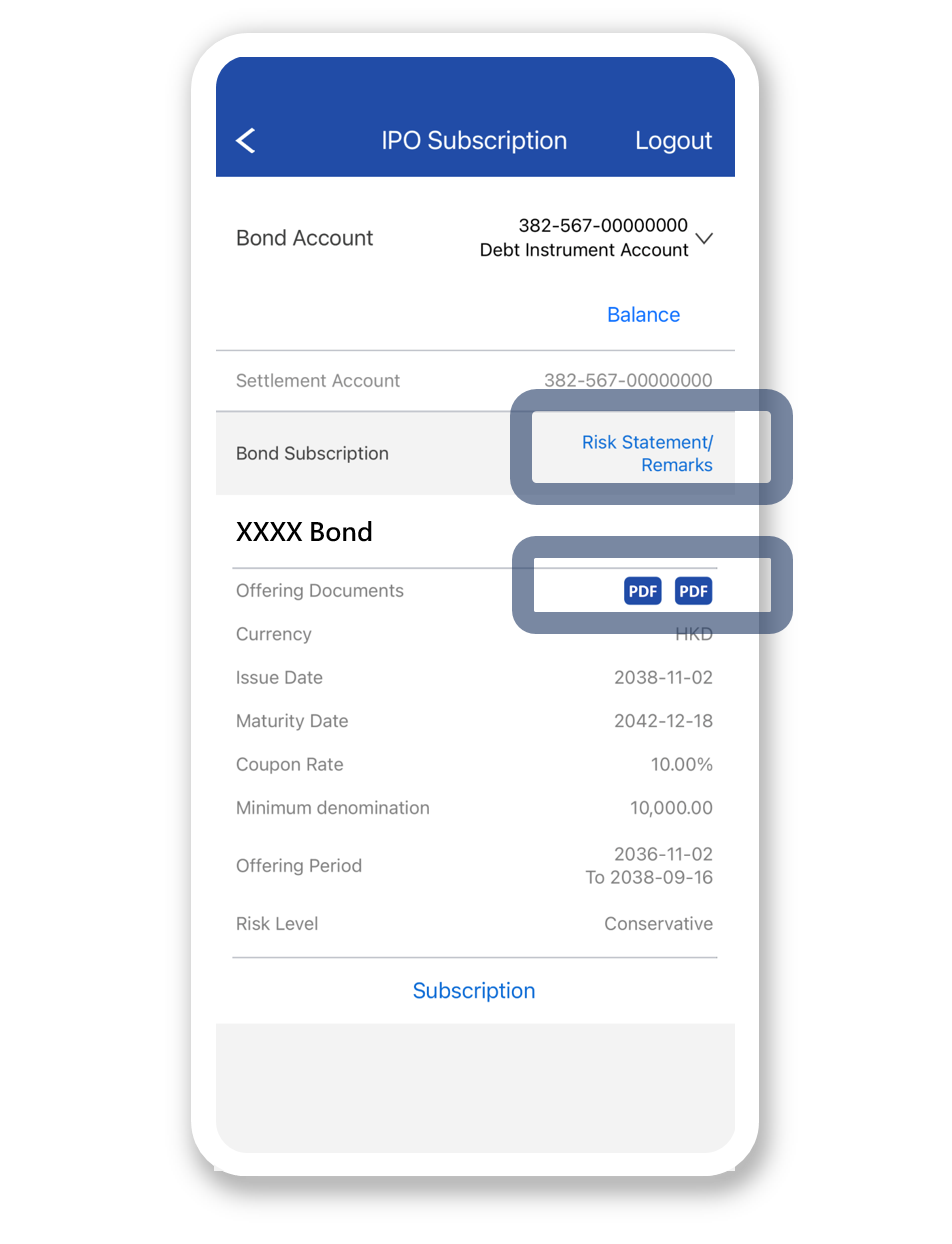

The Bank distributes the bond product for the product issuer and the bond product is a product of the product issuer but not that of the Bank. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Bank and the customer out of the selling process or processing of the related transaction, the Bank is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the bond product should be resolved directly between the product issuer and the customer.

Risk Disclosure Statement

-

We make no representation and accept no responsibility as to the accuracy or completeness of the above information. Investor bears the credit risk of the issuer and has no recourse to Bank of Communications (Hong Kong) Limited.

-

The information does not constitute advice to buy or sell any bond. Before entering into any transaction, you are advised to carefully read the prospectus / Offering Circular in details, including the full text of the risk factors stated therein, discuss with your own investment advisor or other appropriate professional to understand the possible risks and benefits of the transaction if needed. You should also take reasonable steps to assess the risks and appropriateness of the transaction in the light of your own risk, financial situation, objectives, investment tenor and circumstances.

-

Bond is not equivalent to deposit, nor should it be treated as a substitute for, time deposit.

-

The interest and principal of the bond are repaid by the issuer, and you must bear the credit risk of the issuer or guarantor (if any). If the issuer or guarantor fails to perform the repayment obligations, you may not be able to get back the principal and interest of the bond. In the worst case, you may lose all of your investment.

-

The price of bonds fluctuates and any individual bond may go down as well as up. Bond investment involves risk, including the possible loss of the principal amount invested.

-

The information on the website does not form part of the Offering Circular.

-

The above information is for reference only and does not constitute any investment solicitation, offer, invitation or advice to subscribe any investment product. This webpage has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

-

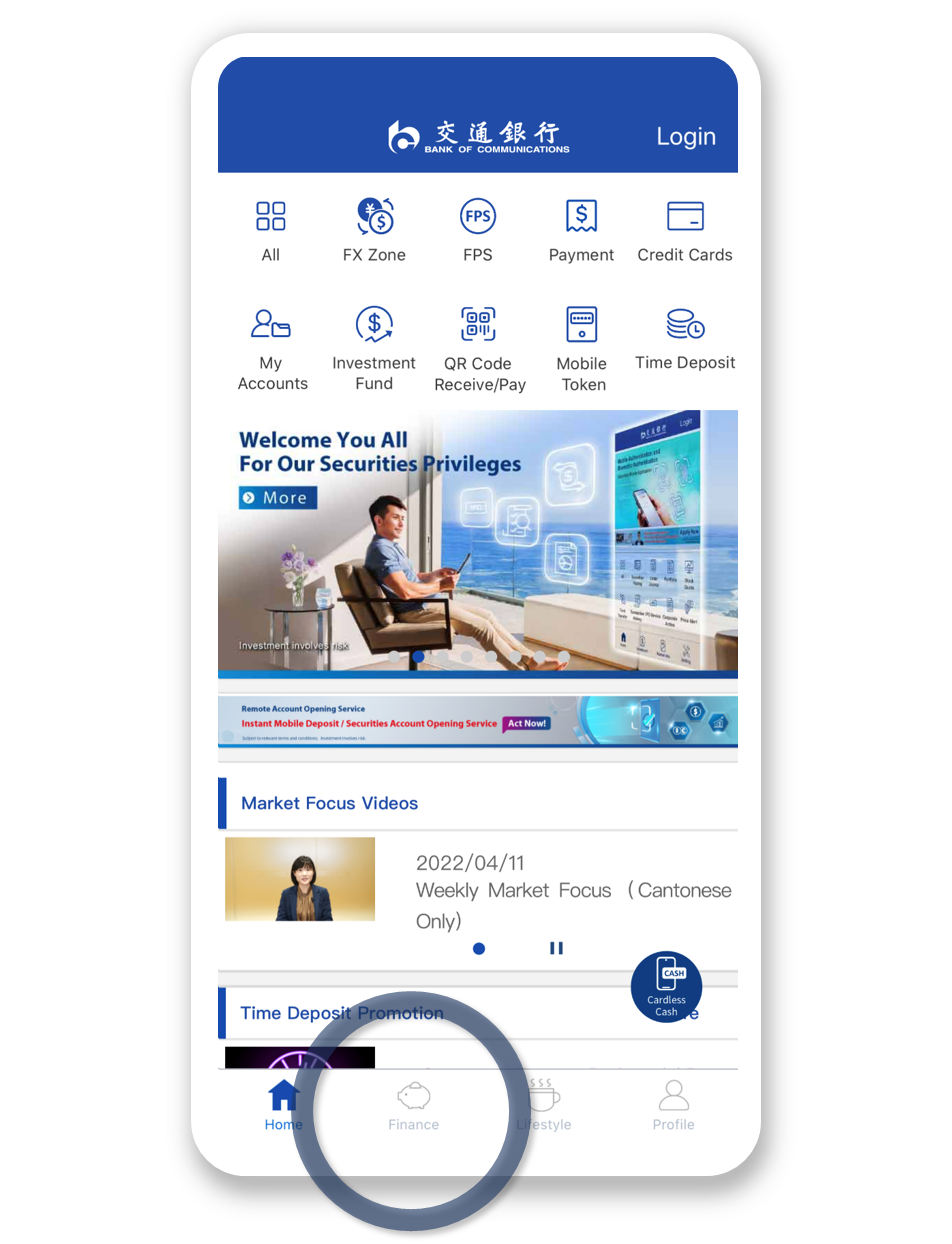

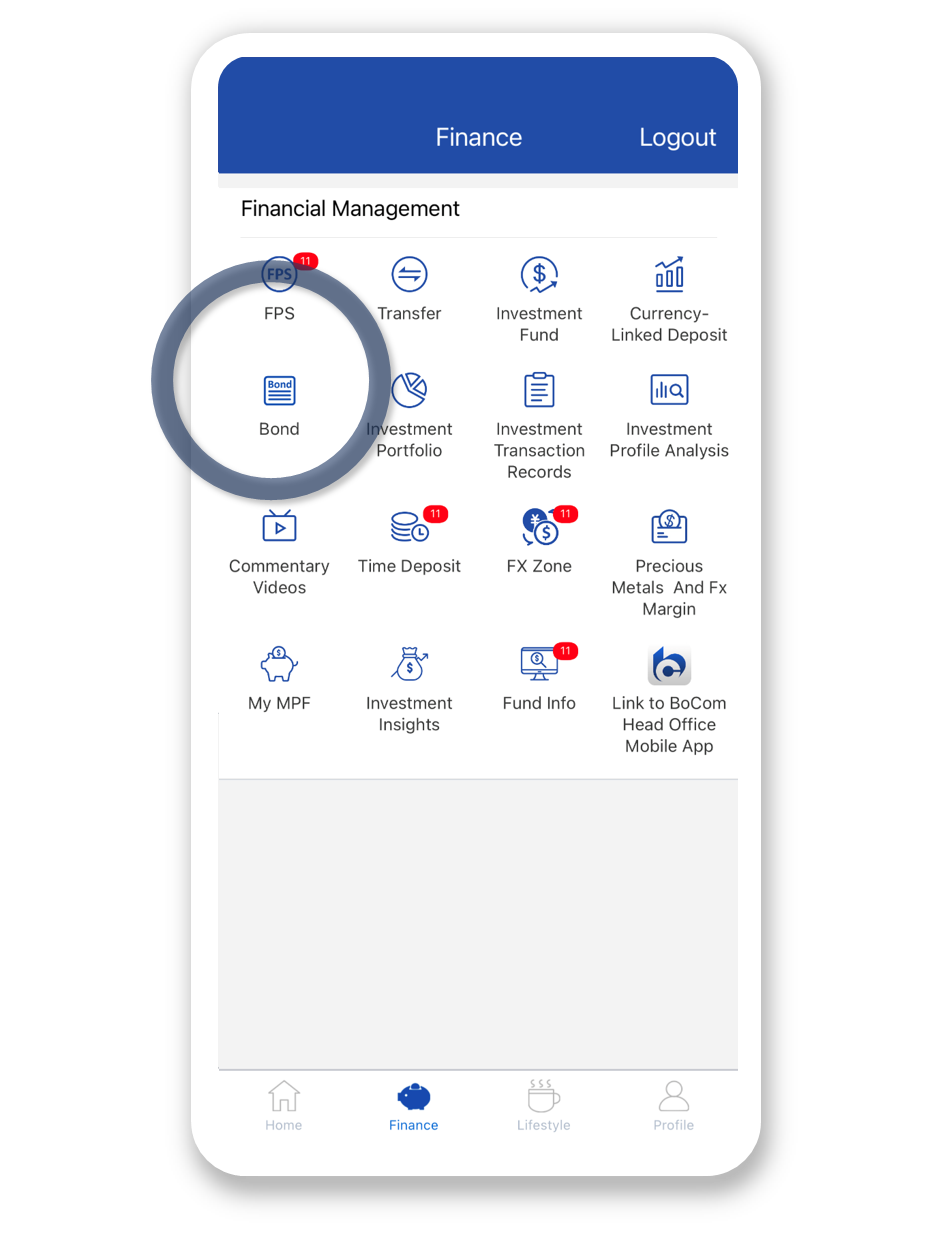

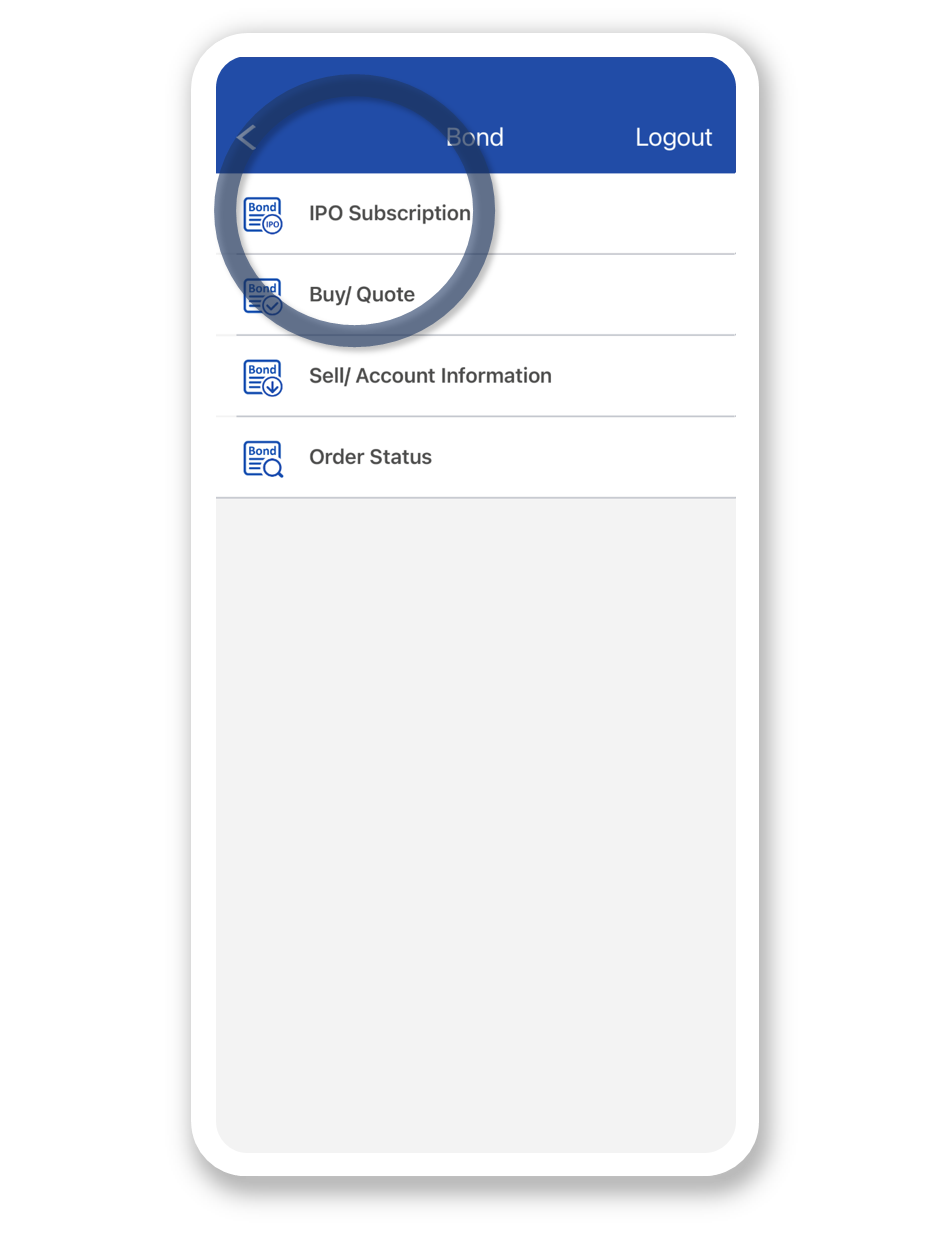

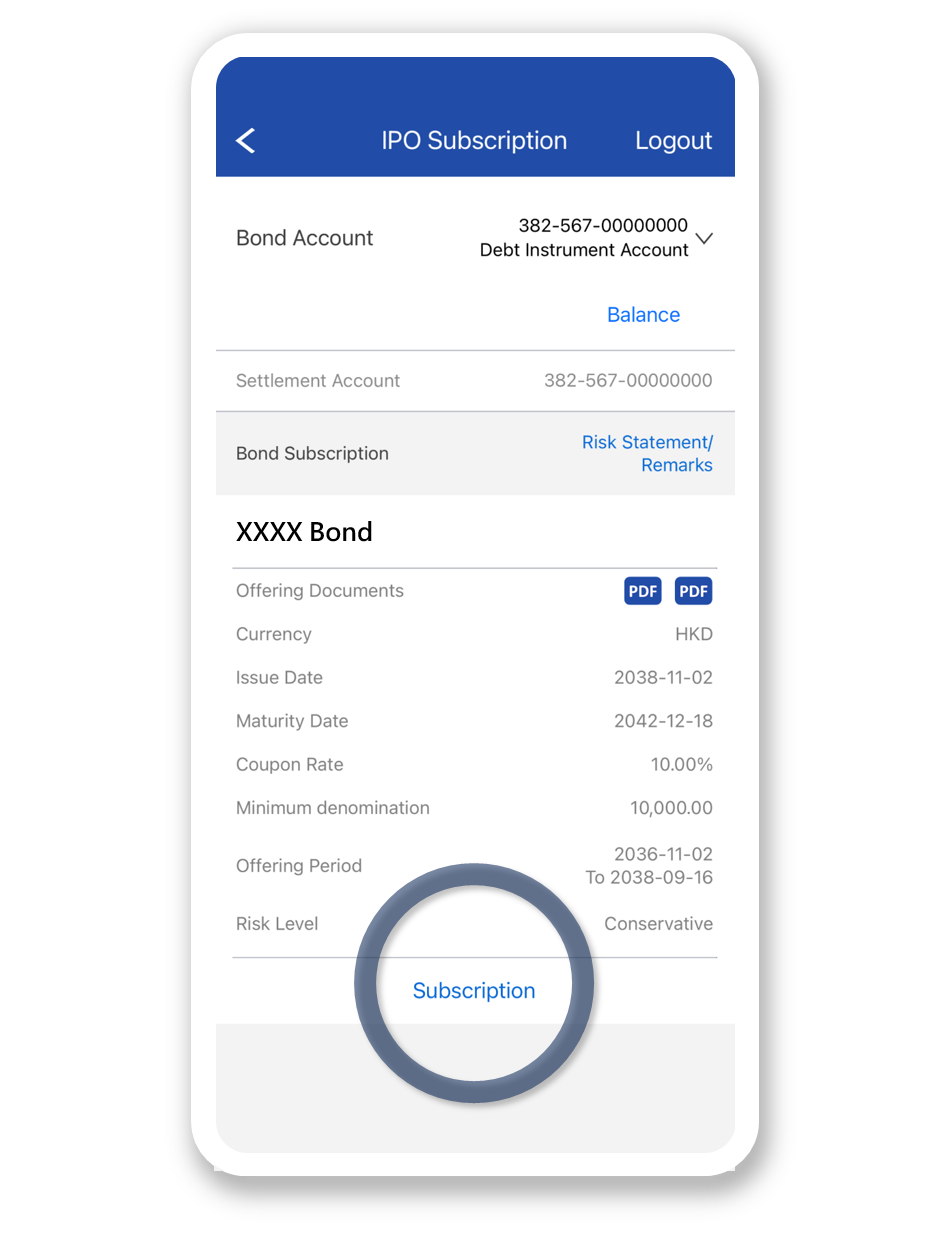

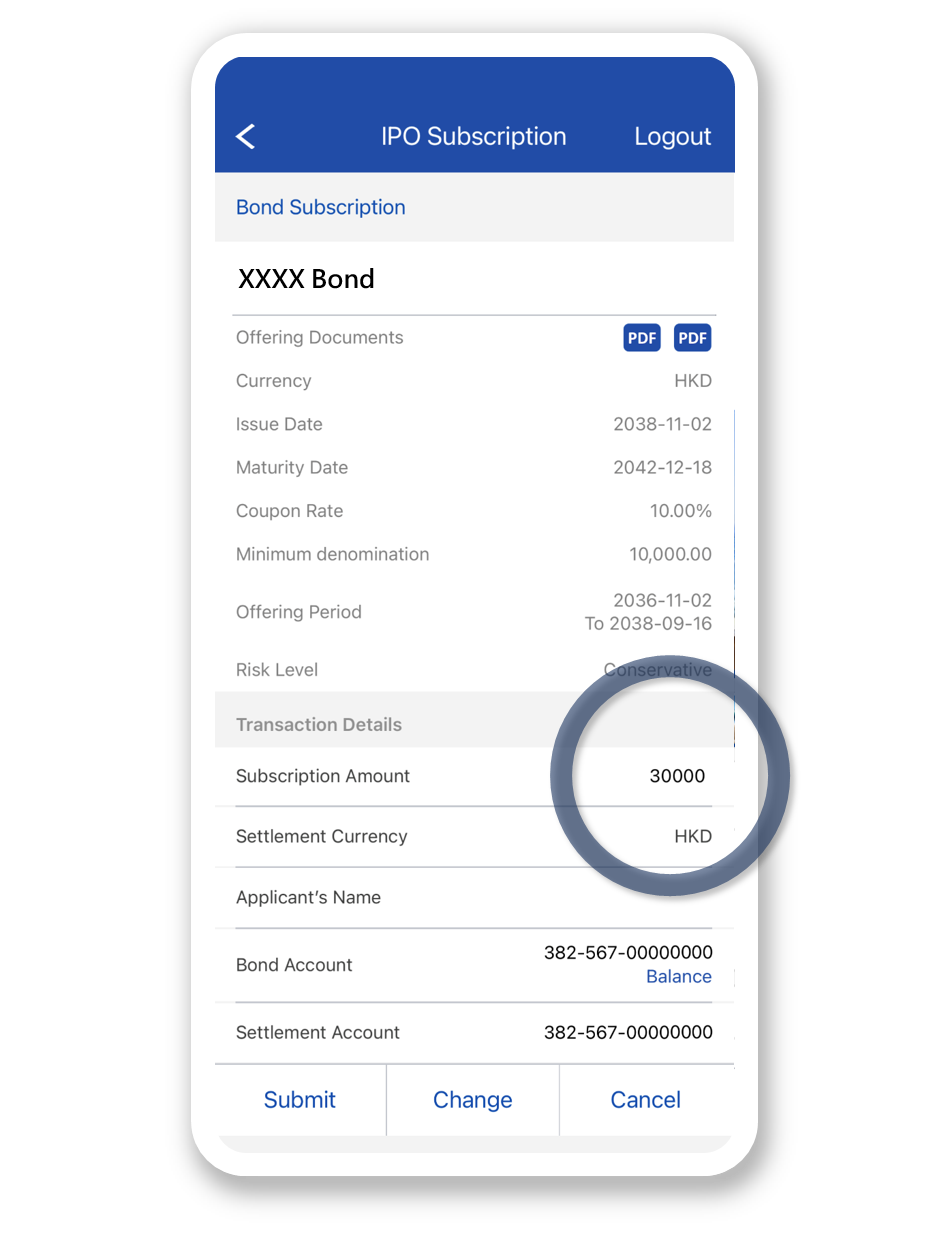

You should have a banking account and a Debt Instrument Account with the Bank to give subscription instruction online.

-

An investment in bonds is not equivalent to a time deposit and should not be taken to replace a time deposit.

Other Information

Customer Service Hotline: 223 95559

Customer Service Hotline: 223 95559

Please visit any of

Please visit any of