2024-04-25

“Build Your Better Future”Promotion (January to March 2024) -“Online Time Deposit” Offer and “90th Anniversary 999 Lucky Draw” Winners ListPlease click here for details.

2024-04-15

Opening of Kwai Chung Wealth Management CentreShould you have any enquiries, please call our Kwai Chung Branch at 3989 3450 or Customer Services Hotline at 223 95559 during office hours.

2024-04-11

Banking System Upgrade Notice

2024-03-28

New Year Lucky Draw - Red Packet Winner List

2024-03-20

Suspension of Debit Card ServicesDue to system upgrade, Debit Card services will be suspended from 6:00a.m. to 9:00a.m. on 14th April 2024. The suspended services include:

- ATM Services

- EPS Transactions (including PPS)

- Debit Card Physical Card Spending Transactions

- Apple Pay Spending Transactions

- UnionPay App Debit Card Transactions

The suspension period may be adjusted subject to the actual system maintenance progress. We apologize for any inconvenience caused. For enquiries, please visit our outlets or call our Customer Service Hotline at 223 95559.

2024-03-18

Closure of Shatin City One BranchPlease be informed that our Shatin City One Branch will be closed at the close of business on Saturday, 18 May 2024 and will be merged with Shatin Branch (Address: Shop Nos. 8D, 8E and 8F, Level 1, Shatin Lucky Plaza, Nos. 1-15 Wang Pok Street, Shatin, New Territories) for business with effect from Monday, 20 May 2024.

Should you have any enquiries, please call our Shatin City One Branch at 3989 3740 or Customer Services Hotline at 2239 5559 during office hours.

Notice to terminate Securities Counter services at Shatin City One Branch

Please be informed that the Securities Counter services of Shatin City One Branch will be terminated on Saturday, 18 May 2024. Customer can continue to enjoy our Securities Trading services via the Internet, Kiosk, Automated IVR telephone service, Operator-assisted hotline and BOCOM(HK) Securities Mobile Application. We apologize for any inconvenience caused.

You can place securities trading order through multiple channels:

- Internet Banking - www.hk.bankcomm.com

- Kiosk

- Automated IVR telephone service / Operator-assisted hotline - 2913 3833

- BOCOM(HK) Securities Mobile Application

Should you have any enquiries, please call our Shatin City One Branch at 3989 3740 or Customer Services Hotline at 2239 5559 during office hours.

Risk Disclosure Statement: The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

2024-03-15

Relocation Notice for North Point Branch

2024-03-14

Banking System Upgrade Notice

2024-02-29

New Year Lucky Draw - Notice of the end of ‘Instant Win’ Cash RewardsDue to overwhelming response, the quota of ‘Instant Win’ Cash Rewards is full. Thank you for your support!

For enquiries, please contact our Customer Services Hotline at (852) 223 95559 during office hours.

Bank of Communications (Hong Kong) Winter Top Rewards Lucky Draw—The Activate Internet Banking Lucky Draw

For the Phase 2 Winner List, please click here

2024-02-19

Opening of Sheung Shui Wealth Management CentrePlease be informed that with effect from Monday, 19th February 2024, Sheung Shui Wealth Management Centre will be opened for business in G/F and 1/F, No. 89-95 San Fung Avenue, New Territories to provide a comprehensive banking services (Note: Non-Cash Counter Transactions Provided).

Should you have any enquiries, please call our Sheung Shui Branch at 3989 3880 or Customer Services Hotline at 223 95559 during office hours.

2024-01-29

Extension of ‘SMS Sender Registration Scheme’ to Banking IndustryTo help members of the public verify the identities SMS sender, and prevent fraudsters from sending scam SMS messages masquerading as banks, ‘SMS Sender Registration Scheme’ will be launched with the support of the Hong Kong Monetary Authority, the Hong Kong Association of Banks, the Hong Kong Police Force, Office of the Communications Authority and the telecommunications industry.

Effective from 28 January 2024, the Bank will use the following ‘Registered SMS Sender IDs’ with the prefix ‘#’ to send SMS messages to local subscribers of mobile services:

#BANKCOMM

#BOCOM

#BOCOMHK

Please note that the Scheme is not applicable to local subscribers of Single-Card-Multiple-Numbers / One-Card-Two-Numbers mobile service provided by non-Hong Kong operators.

2024-01-26

Investment Fund Trading System Maintenance Notice

2024-01-16

Subscription Channels for Airport Authority Retail BondsFrom 17 January 2024 9:00 a.m. till 25 January 2024 2:00 p.m., customers, who subscribe the Airport Authority Retail Bonds through our branches, internet banking, mobile banking or subscription hotline, will enjoy 7 fee waiver including Subscription Handling Fee, Buy Transaction Fee, Sell Transaction Fee, Redemption Fee at maturity, Custodian Fee, Cash Collection Fee and Service charge for Transfer In of bond. (Service charge for Transfer Out of bond is applied (if applicable), please refer to “Charges of Retail Banking Services” for details). Investment involves risks. Please click here for details.

2023-12-17

Closure of Fanling BranchPlease be informed that our Fanling Branch will be closed at the close of business on Saturday, 17 February 2024 and merged with Sheung Shui Branch (Address: Shops 1010-1014, G/F., Sheung Shui Centre, Sheung Shui, New Territories) for business with effect from Monday, 19 February 2024.

Should you have any enquiries, please call our Fanling Branch at 3989 3900 or Customer Services Hotline at 2239 5559 during office hours.

Notice to terminate Securities Counter services at Fanling Branch

Please be informed that the Securities Counter services of Fanling Branch will be terminated on Saturday, 17 February 2024. Customer can continue to enjoy our Securities Trading services via the Internet, Kiosk, Automated IVR telephone service, Operator-assisted hotline and BOCOM(HK) Securities Mobile Application. We apologize for any inconvenience caused.

You can place securities trading order through multiple channels:

- Internet Banking - www.hk.bankcomm.com

- Kiosk

- Automated IVR telephone service / Operator-assisted hotline - 2913 3833

- BOCOM(HK) Securities Mobile Application

2023-12-07

Notice of the Launch of “FPS x PromptPay QR Payment” Services“FPS x PromptPay QR Payment” services are launched on 4 December 2023. Customers are able to utilize their BOCOM(HK) Mobile App scan QR Code and make payments at over 8 million PromptPay merchants in Thailand via FPS, while Thai visitors can pay at FPS merchants via scanning FPS QR code in Hong Kong via PromptPay. This enhances the payment experience and provides an additional safe and faster option to customers in both places. For details of the Cross Border QR Payment Services, please click here.

2023-12-01

System Maintenance NoticeFor enquiries, please contact our Customer Services Hotline at (852) 223 95559 during office hours.

2023-11-24

Important Security Notice: Exercise Caution with Mobile ApplicationsPlease exercise utmost caution regarding malware that can manipulate your mobile device. When you are prompted to open suspicious links or download applications, it is crucial to proceed with caution. Before installing any applications, take the time to carefully evaluate the permission requirements of the respective mobile applications. If you come across any suspicious permission requests, it is advised not to install the related mobile applications. Unless you are completely certain, do not allow your system to install mobile applications from unknown sources. For details, please click here.

2023-11-17

Securities Trading System Maintenance NoticeTo improve our service, our Securities Trading System will be under maintenance during the period from 12:00 am to 12:00 pm on 19 November 2023 (Sunday) (Hong Kong Time). During that period, our Securities Trading Services will be affected. We apologize for any inconvenience caused.

For enquiries, please contact our Customer Services Hotline at (852) 223 95559 during office hours.

2023-11-16

Notice of the Changes in Securities Trading ServicesWith effect from 17 November 2023, our securities service charges will be revised. For details, please click here.

2023-11-08

Notice for change of Customer Opinion Hotline number and system upgradeTo improve our service, we will upgrade the hotline system and transfer the hotline number during the period from 3:30 am to 7 am on 9 December 2023 (Saturday) (Hong Kong Time). During that period, hotline services may be affected. We apologize for any inconvenience caused.

Please note that our Customer Opinion Hotline number will be changed to 2165 6123 from 7 am on 9 December 2023 (Saturday) (Hong Kong Time) onwards.

For enquiries, please contact our Customer Services Hotline at (852) 223 95559 during office hours.

2023-10-24

Notice of adjustment on Charges of Retail Banking Services

2023-10-16

Notice of Amendments on Bank of Communications (HongKong) Limited (“Bank”) DreamCash Personal Loan Terms and Conditions DreamCash Tax Loan Terms and ConditionsPhone Banking System Maintenance Notice

2023-10-11

Relocation of Global Banking

2023-10-10

Notice on Shatin Branch Services  |

2023-09-29

Faster Payment System FPS Maintenance Notice| Date | From | To | Service Not Available |

| 26 Nov 2023 (Sunday) |

01:00 | 11:15 | Internet Banking Services, Mobile Banking Services: FPS Service Setting, FPS Fund Transfer, FPS Transaction Enquiry, FPS QR Code, Electronic Direct Debit Authorization (abbr: eDDA, which is only applicable to Internet Banking Services) Corporate Internet Banking Services# , Corporate Mobile Banking#: FPS Transfer, FPS Addressing Services, FPS Refund, Upload batch transactions (FPS – General Transfer), FPS Transactions Enquiry, FPS Merchant Service , eDDA BComONE – Academy: FPS QR code Payment Services Merchant Payment Collection Service: FPS QR code Payment Collection Services |

2023-09-27

Closure of Siu Sai Wan Branch

2023-09-25

Bank of Communications (Hong Kong) extends Business Hours for 3 Selected BranchesMonday to Saturday: 9a.m. to 5p.m.

Tsim Sha Tsui Branch: Shop Nos 1-3 on G/F, CFC Tower, 22-28 Mody Road, Tsimshatsui, Kowloon

Sheung Shui Branch: Shops 1010-1014, G/F, Sheung Shui Centre, Sheung Shui, New Territories

Bank of Communications (Hong Kong) Top Rewards Lucky Draw - Phase 3 Chill Rewards Winner List.

For details, please click here.

2023-09-17

Subscription Channels for Retail Green Bonds issued by The Government of The Hong Kong Special Administrative RegionFrom 18 September 2023 9:00 a.m. till 28 September 2023 2:00 p.m., customers, who subscribe the Government of Hong Kong Special Administrative Region Retail Green Bonds through our branches, internet banking, mobile banking or subscription hotline, will enjoy 7 fee waiver including Subscription Handling Fee, Buy Transaction Fee, Sell Transaction Fee, Redemption Fee at maturity, Custodian Fee, Cash Collection Fee and Service charge for Transfer In of bond. (Service charge for Transfer Out of bond is applied (if applicable), please refer to “Charges of Retail Banking Services” for details). Investment involves risks. Please click here for details.

2023-09-01

Notice to terminate Securities Counter services at North Point BranchPlease be informed that the Securities Counter services of North Point Branch will be terminated on Saturday, 2 December 2023. Customer can continue to enjoy our Securities Trading services via the Internet, Kiosk, Automated IVR telephone service, Operator-assisted hotline and BOCOM(HK) Securities Mobile Application. We apologize for any inconvenience caused.

You can place securities trading order through multiple channels:

- Internet Banking - www.hk.bankcomm.com

- Kiosk

- Automated IVR telephone service / Operator-assisted hotline - 2913 3833

- BOCOM(HK) Securities Mobile Application

Should you have any enquiries, please call our North Point Branch at 3989 3268 or Customer Services Hotline at 223 95559 during office hours.

Risk Disclosure Statement

The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

2023-08-28

Notice of the Changes in Securities Trading ServicesBank of Communications (Hong Kong) Top Rewards Lucky Draw - Phase 2 Chill Rewards Winner List.

For details, please click here.

2023-08-10

Bank of Communications (Hong Kong) Top Rewards Lucky Draw - Phase 1 Chill Rewards Winner List.For details, please click here.

2023-08-01

Notice to terminate Securities Counter services at Siu Sai Wan Branch- Internet Banking - www.hk.bankcomm.com

- Kiosk

- Automated IVR telephone service / Operator-assisted hotline - 2913 3833

- BOCOM(HK) Securities Mobile Application

2023-07-28

2023 Q2 Remote Account Opening Service Welcome Rewards – HKD 888 Cash Reward Draw Winner ListPlease click here for details.

2023-07-27

Subscription Channels for Silver Bond issued by The Government of The Hong Kong Special Administrative RegionFrom 28 July 2023 9:00 a.m. till 9 August 2023 2:00 p.m., customers, who subscribe the Government of Hong Kong Special Administrative Region Silver Bond through our branches, internet banking, mobile banking or subscription hotline, will enjoy 7 fee waiver including Subscription Handling Fee, Buy Transaction Fee, Sell Transaction Fee, Redemption Fee at maturity, Custodian Fee, Cash Collection Fee and Service charge for Transfer In of bond. (Service charge for Transfer Out of bond is applied (if applicable), please refer to “Charges of Retail Banking Services” for details). Investment involves risks. Please click here for details.

2023-06-07

“BOCOM The Year Of Rabbit” Promotion:5th Anniversary Lucky Pocket DrawWinners List

2023-06-02

Mobile Token System Maintenance Notice

2023-06-01

Notice of Amendments regarding FWD Cobrand Card product offerPlease click here for details.

Notice of adjustment on Charges of Retail Banking Services

2023-05-16

Notice of Temporary Suspension of Coupon Station Service

2023-05-05

Remote Account Opening Service Welcome Rewards – New Year's HKD 888 Red Packet Draw Winner List Please click here for details.

2023-05-02

Notice to terminate Securities Counter services at Kwai Chung BranchPlease be informed that the Securities Counter services of Kwai Chung Branch will be terminated on Saturday, 8 July 2023. Customer can continue to enjoy our Securities Trading services via the Internet, Kiosk, Automated IVR telephone service, Operator-assisted hotline and BOCOM(HK) Securities Mobile Application. We apologize for any inconvenience caused.

- Internet Banking - www.hk.bankcomm.com

- Kiosk

- Automated IVR telephone service / Operator-assisted hotline - 2913 3833

- BOCOM(HK) Securities Mobile Application

2023-04-25

Faster Payment System FPS Maintenance Notice| Date | From | To | Service Not Available |

| 14 May 2023 (Sunday) |

01:00 | 11:15 | Personal Internet Banking Services, Mobile Banking Services: FPS Service Setting, FPS Fund Transfer, FPS Transaction Enquiry, FPS QR Code, Electronic Direct Debit Authorization (abbr: eDDA, which is only applicable to Internet Banking Services) Corporate Internet Banking Services# , Corporate Mobile Banking#: FPS Transfer, FPS Addressing Services, FPS Refund, Upload batch transactions (FPS – General Transfer), FPS Transactions Enquiry, FPS Merchant Service , eDDA BComONE – Academy: FPS QR code Payment Services Merchant Payment Collection Service: FPS QR code Payment Collection Services |

2023-03-30

Notice of adjustment on Charges of Retail Banking Services With effect from 30 April 2023, our Charges of Retail Banking Services will be adjusted, please click here to download the “Customer Notice” .

2023-03-01

Relocation of Shatin Branch

2023-02-22

“BOCOM Hong Kong 88th Anniversary Presents” Promotion: Rewards you with HKD88,888 Cash Rebate Lucky Draw Winners List

2023-02-21

Real-name Registration for SIM Card Special Announcement

2023-02-06

Q4 Remote Account Opening Service Welcome Rewards – 2022 December MyLink Customer Lucky Draw Winner ListPlease click here for details.

2023-01-09

Q4 Remote Account Opening Service Welcome Rewards – 2022 November MyLink Customer Lucky Draw Winner ListPlease click here for details.

2022-12-20

Notice to terminate of Safe Deposit Box Service at Hunghom Branch

2022-12-19

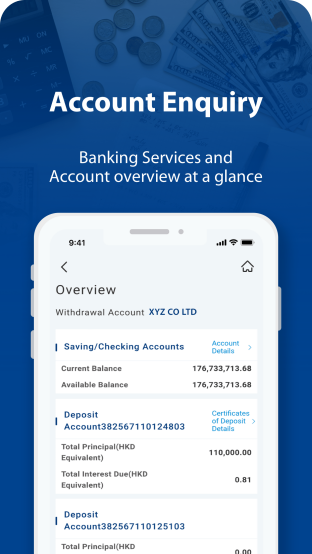

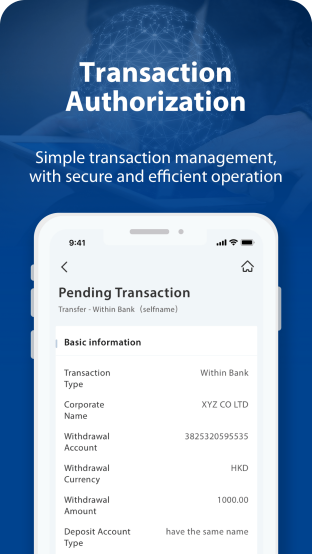

Notice of the launch for “BOCOMHK Corporate Mobile App” mobile applicationNew “BOCOM(HK) Corporate Mobile App” mobile application was launched.

Search and download “BOCOM(HK) Corporate Mobile App” at App Store or Google Play to enjoy the new services. No further application is required if you are existing Corporate Internet Banking customers.

“BOCOM(HK) Corporate Mobile App” mobile application provides the following functions:

| Mobile Token | Use only Mobile Token PIN or Biometric Authentication to login Corporate Mobile App and approve transactions without carrying a physical security device. |

| Account Enquiry | Enquire account balance and transaction records, balances of Loans Accounts, details of remittance transactions, cheque status, e-Statement and transaction records of Master/ Sub Account. |

| Pending Transaction | Enquire, approve or reject transactions which are pending for your approval. |

| Schedule | Enquire or cancel approved scheduled instructions which have not yet been processed. |

| Online Transaction | Enquire the approved“Corporate Internet Banking” and “Corporate Mobile Banking” transactions. |

For enquiries, please contact our Customer Service Hotline at (852)226 99388.

2022-12-16

ATM Cheque Deposit Function Out of ServiceDue to system upgrade, all Cheque deposit functions of our ATMs will be suspended from 09:00am on 17 December 2022 till 6:00pm on 28 December 2022. Please be aware that this will have no impact on other ATM services.

The ATM cheque deposit service suspension period may be adjusted subject to the actual system upgrade progress. We reserve the right to adjust the service suspension period without prior notice. Customers are advised to make necessary arrangement in advance. We apologize for any inconvenience caused.

Should you have any queries, please contact our Customer Services Hotline on (852) 223 95559 for further assistance.

2022-12-15

Notice of Amendments on Terms and Conditions and Key Facts Statement KFS for Bank of Communications HongKong Limited "Bank" DreamCash Personal Loan / Balance Transfer / DreamCash Tax LoanWith effect from 30 December 2022, the Terms and Conditions and Key Facts Statement (KFS) in relation to Bank of Communications (Hong Kong) Limited (“Bank”)’s DreamCash Personal Loan / Balance Transfer / Tax Loan will be amended (“Amendments”) which the related Annualised Overdue/Default Interest Rate would be reduced. For details, please click here.

2022-12-09

Celebrations of the 25th Anniversary of the establishment of HKSAR and WeChat Banking Customer Interaction Event: WeChat Online Linkage Lucky Draw Winner ListPlease click here for details.

Q4 Remote Account Opening Service Welcome Rewards – 2022 October MyLink Customer Lucky Draw Winner List

Please click here for details.

2022-11-25

Notice of the Changes in Securities Trading ServicesWith effect from 1 January 2023, our securities service charges will be revised. For details, please click here.

2022-11-18

Celebrations of the 25th Anniversary of the establishment of HKSAR and 88th Anniversary of Bank of Communications in HKSAR: Mobile Banking Lucky Draw-Rainbow Prize Winner ListFor the winner list of Celebrations of the 25th Anniversary of the establishment of HKSAR and 88th Anniversary of Bank of Communications in HKSAR: Mobile Banking Lucky Draw - Rainbow Prize, please click here.

2022-11-10

2022Q3 Savings Growth Reward x 88th Anniversary 3328 Lucky Draw -----“Reward 2: 88th Anniversary 3328 Lucky Draw”Winners ListPlease click here for details.

2022-11-01

2022Q3“Double Happiness” Promotion July to September 2022 -“Online Delighted Time Deposit” x “HKSAR 25th Anniversary's 2022 Lucky Draw” Winners ListPlease click here for details.

2022-10-26

Relocation of Ngau Tau Kok BranchPlease be informed that with effect from Monday, 16 January 2023, Ngau Tau Kok Branch will be moved to Shop E1 & Portion of Shop D, G/F, Lee Kee Building, No. 55 Ngau Tau Kok Road, Kowloon for business.

Should you have any enquiries, please call our Ngau Tau Kok Branch at 3989 3600 or Customer Services Hotline at 223 95559 during office hours.

Notice to terminate Securities Counter services at Ngau Tau Kok Branch

- Internet Banking - www.hk.bankcomm.com

- Kiosk

- Automated IVR telephone service / Operator-assisted hotline - 2913 3833

- BOCOM(HK) Securities Mobile Application

2022-10-25

Faster Payment System FPS Maintenance NoticeAccording to HKICL, the FPS services of Personal Internet Banking, Mobile Banking, Corporate Internet Banking, BComONE – Academy and Merchant Payment Collection Service will be unavailable from 1:00 am to 11:15 am on 30 October 2022 (Sunday) due to maintenance of FPS system. For details, please refer to the table below:

| Date | From | To | Service Not Available |

| 30 Oct 2022 (Sunday) | 01:00 | 11:15 |

Personal Internet Banking Services, Mobile Banking Services: FPS Service Setting, FPS Fund Transfer, FPS Transaction Enquiry, FPS QR Code, Electronic Direct Debit Authorization (abbr: eDDA, which is only applicable to Internet Banking Services) Corporate Internet Banking Services#: FPS Transfer, FPS Addressing Services, FPS Refund, Upload batch transactions (FPS – General Transfer), FPS Transactions Enquiry, FPS Merchant Service , eDDA BComONE – Academy: FPS QR code Payment Services Merchant Payment Collection Service: FPS QR code Payment Collection Services |

The FPS service suspension period may be adjusted subject to the actual system maintenance progress. We reserve the right to adjust the service suspension period without prior notice. Customers are advised to make necessary arrangement in advance. We apologize for any inconvenience this may cause.

For enquiries, please contact our Customer Services Hotline at (852) 223 95559 during office hours.

#For enquiries of Corporate Internet Banking Services, please contact our Customer Services Hotline at (852) 226 99388.

2022-10-19

Bank of Communications (Hong Kong) Announces Branch Service Change UpdateBank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. In view of the latest COVID-19 situation, we now update our precautionary measures and our service arrangements.

| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Wanchai Branch | Shop B on G/F., Johnston Court, 32-34 Johnston Road, Hong Kong | 19 October (Wednesday) | 20 October(Thursday) |

2022-10-17

Bank of Communications (Hong Kong) Announces Branch Service Change UpdateBank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. In view of the latest COVID-19 situation, we now update our precautionary measures and our service arrangements.

| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Quarry Bay Branch | Shops 2, G/F., No. 1001 King's Road, Quarry Bay, Hong Kong | 17 October (Monday) | 18 October(Tuesday) |

2022-10-15

Bank of Communications (Hong Kong) Announces Branch Service Change UpdateBank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. In view of the latest COVID-19 situation, we now update our precautionary measures and our service arrangements.

| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Chaiwan Branch | G/F., 121-121A Wan Tsui Road, Chai Wan Cinema Building, Chaiwan, Hong Kong | 15 October (Saturday) | 17 October(Monday) |

2022-10-14

Bank of Communications (Hong Kong) Announces Branch Service Change UpdateBank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. In view of the latest COVID-19 situation, we now update our precautionary measures and our service arrangements.

| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| King's Road Branch | G/F, Kailey Court, 67-71 King's Road, Hong Kong | 14 October (Friday) | 15 October(Saturday) |

Notice of the Changes in Securities Trading Services

With effect from 14 November 2022, our securities service charges will be revised. For details, please click here.

2022-10-12

Bank of Communications (Hong Kong) Announces Branch Service Change UpdateBank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. In view of the latest COVID-19 situation, we now update our precautionary measures and our service arrangements.

| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Taikoo Shing Branch | Shop 38, G/F., CityPlaza 2, 18 Taikoo Shing Road, Hong Kong | 12 October (Wednesday) | 13 October(Thursday) |

2022-10-03

Bank of Communications (Hong Kong) Announces Branch Service Change UpdateBank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. In view of the latest COVID-19 situation, we now update our precautionary measures and our service arrangements.

| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| King's Road Branch | G/F, Kailey Court, 67-71 King's Road, Hong Kong | 3 October (Monday) | 5 October(Wednesday) |

2022-09-30

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Kowloon | |||

| Lam Tin Branch | Shop No. 5 & 9, G/F., Kai Tin Towers, 51-67C Kai Tin Road, Lam Tin, Kowloon | 30 September (Friday) |

3 October (Monday) |

2022-09-29

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Wanchai Branch | Shop B on G/F., Johnston Court, 32-34 Johnston Road, Hong Kong | 29 September (Thursday) |

30 September (Friday) |

| Kowloon | |||

| Lam Tin Branch | Shop No. 5 & 9, G/F., Kai Tin Towers, 51-67C Kai Tin Road, Lam Tin, Kowloon | 29 September (Thursday) |

30 September (Friday) |

2022-09-28

Bank of Communications (Hong Kong) Announces Branch Service Change UpdateBank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. In view of the latest COVID-19 situation, we now update our precautionary measures and our service arrangements.

| Branch Name | Address | Closing Date | Re-Opening Date |

| Kowloon | |||

|

Mongkok Branch |

G/F and 1/F, Shun Wah Building, Nos. 735 & 735A Nathan Road, Mongkok, Kowloon |

28 September (Wednesday) |

29 September (Thursday) |

2022-09-26

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| New Territories | |||

|

Nina Tower Wealth Management Centre |

Suite 2304 on 23/F, Tower 2, Nina Tower, No. 8, Yeung Uk Road, Tsuen Wan, New Territories | 26 September (Monday) |

27 September (Tuesday) |

| Tseung Kwan O Branch | Shop Nos. 252A, 252B & 253 on Level 2, Metro City Phase I, Tseung Kwan O, New Territories | 26 September (Monday) |

27 September (Tuesday) |

2022-09-24

Bank of Communications (Hong Kong) Announces Branch Service Change UpdateBank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. In view of the latest COVID-19 situation, we now update our precautionary measures and our service arrangements.

| Branch Name | Address | Closing Date | Re-Opening Date |

| New Territories | |||

|

Tiu Keng Leng Branch |

Shops Nos. L2-064 and L2- 065, Level 2, Metro Town, Tiu Keng Leng, New Territories |

24 September (Saturday) |

26 September (Monday) |

2022-09-19

Bank of Communications (Hong Kong) Announces Branch Service Change UpdateBank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. In view of the latest COVID-19 situation, we now update our precautionary measures and our service arrangements.

| Branch Name | Address | Closing Date | Re-Opening Date |

| Kowloon | |||

|

Hunghom Branch |

Shop A6, G/F., Whampoa Estate Planet Square, 1-3 Tak Man Street, Kowloon |

19 September (Monday) |

20 September (Tuesday) |

2022-09-15

System Maintenance Notice – Extension of Suspension PeriodDue to system maintenance of the Bank, Internet Banking Services, Mobile Banking Services, Securities Mobile Application and Corporate Internet Banking Services will be suspended on the following time slot (Hong Kong Time). For details, please refer to the table below:

| Date | From | To | Service Not Available |

|

September 18, 2022 (Sunday) |

1:00 a.m | 7:00 a.m |

Internet Banking Services*, Mobile Banking Services*, Securities Mobile Application and Corporate Internet Banking Services*# *(suspension period will be extended for around 2 hours against the original maintenance schedule 1:00 – 5:00) |

The service suspension period may be adjusted subject to the maintenance progress. We reserve the right to adjust the service suspension period without prior notice. Customers are advised to make necessary arrangement/ related payment for the required service in advance. We apologize for any inconvenience caused.

For enquiries, please contact our Customer Services Hotline at (852) 223 95559 during office hours.

# For enquiries on Corporate Banking Customer Services, please contact our Customer Services Hotline at (852)226 99388 during office hours.

Investment involves risk

Bank of Communications (Hong Kong) Announces Branch Service Change Update

| Branch Name | Address | Closing Date | Re-Opening Date |

| New Territories | |||

|

Kwong Yuen Estate Branch |

Shop Nos. 1 & 2, G/F., Commercial Block 2, Kwong Yuen Shopping Centre, Kwong Yuen Estate, No. 68 Siu Lek Yuen Road, Shatin, New Territories | 15 September (Thursday) |

16 September (Friday) |

2022-09-14

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Central District Branch | G/F., Far East Consortium Building, 125A Des Voeux Road C., Central, Hong Kong | 14 September (Wednesday) |

15 September (Thursday) |

2022-09-13

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Taikoo Shing Branch | Shop 38, G/F., CityPlaza 2, 18 Taikoo Shing Road, Hong Kong | 13 September (Tuesday) |

14 September (Wednesday) |

2022-09-08

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Aberdeen Branch | Shop 3, G/F, 2/4 & 14/16 Nam Ning Street, Aberdeen Centre (Site 4), Aberdeen, Hong Kong | 8 September (Thursday) |

9 September (Friday) |

| New Territories | |||

| Tuen Mun Branch | Shops 7-8 on G/F, Castle Peak Lin Won Building, 2-4 Yan Ching Street, Tuen Mun, New Territories | 8 September (Thursday) |

9 September (Friday) |

2022-09-07

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| New Territories | |||

| Ma On Shan Branch | Shop Nos. 303-304, Level 3, Ma On Shan Plaza, 608 Sai Sha Road, Ma On Shan, New Territories | 7 September (Wednesday) |

8 September (Thursday) |

2022-09-06

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Siu Sai Wan Branch | Shop No. 217A-217B, Siu Sai Wan Plaza, Siu Sai Wan Estate, Hong Kong | 6 September (Tuesday) |

7 September (Wednesday) |

| Kennedy Town Branch | G/F., 113-119 Belcher's Street, Kennedy Town, Hong Kong | 6 September (Tuesday) |

7 September (Wednesday) |

| Kowloon | |||

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon | 6 September (Tuesday) |

7 September (Wednesday) |

| New Territories | |||

| Tseung Kwan O Branch | Shop Nos. 252A, 252B & 253 on Level 2, Metro City Phase I, Tseung Kwan O, New Territories | 6 September (Tuesday) |

7 September (Wednesday) |

2022-09-05

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| New Territories | |||

| Kwong Yuen Estate Branch | Shops Nos. 1 & 2, G/F., Commercial Block 2, Kwong Yuen Shopping Centre, Kwong Yuen Estate, No. 68 Siu Lek Yuen Road, Shatin, New Territories | 5 September (Monday) |

6 September (Tuesday) |

2022-09-03

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Kennedy Town Branch | G/F., 113-119 Belcher's Street, Kennedy Town, Hong Kong | 3 September (Saturday) |

5 September (Monday) |

| Taikoo Shing Branch | Shop 38, G/F., CityPlaza 2, 18 Taikoo Shing Road, Hong Kong | 3 September (Saturday) |

5 September (Monday) |

2022-09-01

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| New Territories | |||

| Sha Tsui Road Branch | Shops Nos. 3-5 on G/F., Kwong Ming Building, 120-130 Sha Tsui Road, Tsuen Wan, New Territories | 1 September (Thursday) |

2 September (Friday) |

2022-08-30

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Business Department | Unit B B/F & G/F, Unit C G/F, Wheelock House, 20 Pedder Street, Central, Hong Kong | 30 August (Tuesday) |

31 August (Wednesday) |

| Kowloon | |||

| Tokwawan Branch | Shop 1-3, G/F., Ocean Mansion, 370-376 Ma Tau Wai Road, Tokwawan, Kowloon | 30 August (Tuesday) |

31 August (Wednesday) |

| New Territories | |||

| Market Street Branch | G/F., 49-55 Tsuen Wan Market Street, Tsuen Wan, New Territories | 30 August (Tuesday) |

31 August (Wednesday) |

| Tai Po Branch | Shop No. 1, 2, 26 & 27, G/F., Wing Fai Plaza, 29-35 Ting Kok Road, Tai Po, New Territories | 30 August (Tuesday) |

31 August (Wednesday) |

2022-08-26

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| New Territories | |||

|

Nina Tower Wealth Management Centre |

Suite 2304 on 23/F, Tower 2, Nina Tower, No. 8, Yeung Uk Road, Tsuen Wan, New Territories | 26 August (Friday) |

27 August (Saturday) |

2022-08-24

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Siu Sai Wan Branch | Shop No. 217A-217B, Siu Sai Wan Plaza, Siu Sai Wan Estate, Hong Kong | 24 August (Wednesday) |

25 August (Thursday) |

| Shau Kei Wan Branch | Shop 2-3, G/F., Tung Fai Building, 161-165 Shau Kei Wan Main Street East, Hong Kong | 24 August (Wednesday) |

25 August (Thursday) |

2022-08-23

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Business Department | Unit B B/F & G/F, Unit C G/F, Wheelock House, 20 Pedder Street, Central, Hong Kong | 23 August (Tuesday) |

24 August (Wednesday) |

2022-08-22

Subscription Channels for Silver Bond issued by The Government of The Hong Kong Special Administrative RegionSubscription Channels for Silver Bond issued by The Government of The Hong Kong Special Administrative Region

From 23 August 2022 9:00 a.m. till 2 September 2022 2:00 p.m., customers, who subscribe the Government of Hong Kong Special Administrative Region Silver Bond through our branches, internet banking, mobile banking or subscription hotline, will enjoy 7 fee waiver including Subscription Handling Fee, Buy Transaction Fee, Sell Transaction Fee, Redemption Fee at maturity, Custodian Fee, Cash Collection Fee and Service charge for Transfer In of bond. (Service charge for Transfer Out of bond is applied (if applicable), please refer to “Charges of Retail Banking Services” for details). Investment involves risks. Please click here for details.

2022-08-17

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Kowloon | |||

| Hunghom Branch | Shop A6, G/F., Whampoa Estate Planet Square, 1-3 Tak Man Street, Kowloon | 17 August (Wednesday) |

18 August (Thursday) |

| New Territories | |||

| Shatin City One Branch | Shop 188, 1/F., Fortune City One, City One Shatin, New Territories | 17 August (Wednesday) |

18 August (Thursday) |

2022-08-16

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Business Department | Unit B B/F & G/F, Unit C G/F, Wheelock House, 20 Pedder Street, Central, Hong Kong | 16 August (Tuesday) |

17 August (Wednesday) |

| New Territories | |||

| Yuen Long Branch | Shop 2B, G/F, Man Yu Building, 2-14 Tai Fung Street, Yuen Long, New Territories | 16 August (Tuesday) |

17 August (Wednesday) |

2022-08-15

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Wanchai Branch | Shop B on G/F., Johnston Court, 32-34 Johnston Road, Hong Kong | 15 August (Monday) |

16 August (Tuesday) |

2022-08-12

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Hennessy Road Branch | G/F., Bank of Communications Building., 368 Hennessy Road, Hong Kong | 12 August (Friday) |

13 August (Saturday) |

2022-08-05

Optimizing of statement service for Precious Metals And FX Margin Trading ServicesTo provide better and more efficient banking services to customers, starting from August 24, 2022, Bank of Communications (Hong Kong) Ltd. will optimize the statement service for Precious Metals And FX Margin Trading Services. Please click here to download the relevant “Customer Notice”.

Bank of Communications (Hong Kong) Announces Branch Service Change Update

| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Hennessy Road Branch | G/F., Bank of Communications Building., 368 Hennessy Road, Hong Kong | 12 August (Friday) |

13 August (Saturday) |

2022-08-03

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Kowloon | |||

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon | 3 August (Wednesday) |

4 August (Thursday) |

| Hunghom Branch | Shop A6, G/F., Whampoa Estate Planet Square, 1-3 Tak Man Street, Kowloon | 3 August (Wednesday) |

4 August (Thursday) |

2022-08-02

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| North Point Branch |

Shops Nos. 1-4 on G/F., Maylun Apartments, 442-456 King's Road, North Point, Hong Kong | 2 August (Tuesday) |

3 August (Wednesday) |

| Portion B of Shop 13, G/F, King's Tower, No. 480 King's Road, North Point, Hong Kong | |||

2022-08-01

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Business Department | Unit B B/F & G/F, Unit C G/F, Wheelock House, 20 Pedder Street, Central, Hong Kong | 1 August (Monday) |

2 August (Tuesday) |

2022-07-29

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Kowloon | |||

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon | 26 July (Tuesday) | 29 July (Friday) |

| New Territories | |||

| Market Street Branch | G/F., 49-55 Tsuen Wan Market Street, Tsuen Wan, New Territories | 28 July (Thursday) | 1 August (Monday) |

| Sheung Shui Branch | Shops 1010-1014, G/F., Sheung Shui Centre, Sheung Shui, New Territories | 28 July (Thursday) | 1 August (Monday) |

| Tuen Mun Branch | Shops 7-8 on G/F, Castle Peak Lin Won Building, 2-4 Yan Ching Street, Tuen Mun, New Territories | 29 July (Friday) | 1 August (Monday) |

Winner List of 2022 Q1 Internet Banking Services Reward Campaign Online Transaction Lucky Lottery

For the winner list of 2022 Q1 Internet Banking Services Reward Campaign Online Transaction Lucky Lottery, please click here.

Notice of adjustment of General Terms and Conditions for Banking Services

With effect from 29 August 2022, our General Terms & Conditions for Banking Services, Terms and Conditions for General Investment Services and Charges of Retail Banking Services will be adjusted, please click here to download the “Customer Notice” and please click here to download the Personal Data (Privacy) Ordinance.

2022-07-28

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Kowloon | |||

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon | 26 July (Tuesday) | 29 July (Friday) |

| New Territories | |||

| Market Street Branch | G/F., 49-55 Tsuen Wan Market Street, Tsuen Wan, New Territories | 28 July (Thursday) | 1 August (Monday) |

| Sheung Shui Branch | Shops 1010-1014, G/F., Sheung Shui Centre, Sheung Shui, New Territories | 28 July (Thursday) | 1 August (Monday) |

2022-07-26

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address | Closing Date | Re-Opening Date |

| Hong Kong Island | |||

| Shau Kei Wan Branch | Shop 2-3, G/F., Tung Fai Building, 161-165 Shau Kei Wan Main Street East, Hong Kong | 26 July (Tuesday) | 27 July (Wednesday) |

| Kowloon | |||

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon | 26 July (Tuesday) | 29 July (Friday) |

2022-07-25

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Hong Kong Island | |

| Shau Kei Wan Branch |

Shop 2-3, G/F., Tung Fai Building, 161-165 Shau Kei Wan Main Street East, Hong Kong |

2022-07-22

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Hong Kong Island | |

| Hennessy Road Branch |

G/F., Bank of Communications Building., 368 Hennessy Road, Hong Kong |

2022-07-19

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Kowloon | |

| Tokwawan Branch |

Shop 1-3, G/F., Ocean Mansion, 370-376 Ma Tau Wai Road, Tokwawan, Kowloon |

2022-07-18

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Kowloon | |

| Tokwawan Branch |

Shop 1-3, G/F., Ocean Mansion, 370-376 Ma Tau Wai Road, Tokwawan, Kowloon |

2022-07-09

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Hong Kong Island | |

| Hennessy Road Branch | G/F., Bank of Communications Building., 368 Hennessy Road, Hong Kong |

2022-07-07

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Hong Kong Island | |

| Hennessy Road Branch |

G/F., Bank of Communications Building., 368 Hennessy Road, Hong Kong |

2022-05-19

Mobile Token System Maintenance Notice

2022-05-06

Mobile Token System Maintenance Notice

2022-04-26

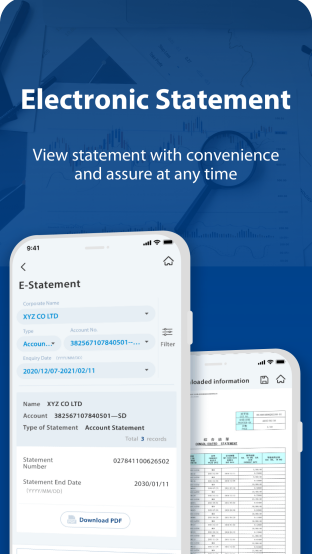

Contribute to the betterment of our environment, Switch to e-Statement / eAdvice

Various kinds of e-Statement / e-Advice are provided for viewing or downloading through our Internet Banking and Mobile Banking. The use of e-Statement / e-Advice services not only reduces the consumption of paper but also provides a convenient way for inquiring anytime and anywhere. Customers could get the latest e-Statement / e-Advice immediately via Internet banking and Mobile Banking without delay due to postal delivery, and save documents for further reference.

Registration for the e-Statement / e-Advice services is simple and convenient. Just login to Internet Banking or Mobile Banking and follow several simple steps to complete the enrolment.

Should you have any queries, please contact our Customer Services Hotline at (852) 223 95559.

2022-04-25

Subscription Channels for Retail Green Bonds issued by The Government of The Hong Kong Special Administrative Region

From 26 April 2022 9:00 a.m. till 6 May 2022 2:00 p.m., customers, who subscribe the Government of Hong Kong Special Administrative Region Retail Green Bonds through our branches, internet banking or mobile banking, will enjoy 7 fee waiver including Subscription Handling Fee, Buy Transaction Fee, Sell Transaction Fee, Redemption Fee at maturity, Custodian Fee, Cash Collection Fee and Service charge for Transfer In of bond. (Service charge for Transfer Out of bond is applied (if applicable), please refer to “Charges of Retail Banking Services” for details). Investment involves risks. Please click here for details.

2022-04-14

Bank of Communications (Hong Kong) Announces Branch Service Change UpdateAfter assessing the latest COVID-19 situation, Bank of Communications (Hong Kong) Limited will resume normal working hours Note of all retail branches starting from 19 April 2022 (Tuesday).

Monday to Friday: 9:00am – 5:00pm

Saturday: 9:00am – 1:00pm

The Bank has been taking precautionary measures prudently at all branches, including more frequent deep cleaning and disinfection of branch premises on top of the regular daily cleaning schedule, all employees are requested to measure their body temperature before work and to put on surgical masks at work. Staff of the Bank would help customers to check body temperature when entering the branches and customers are encouraged to put on surgical masks.

The Bank will continue to closely monitor the situation in order to adopt appropriate epidemic prevention measures and work.

The Bank is committed to maintaining quality banking services. During the special circumstances, customers are advised to use the Bank’s internet banking to meet their banking needs. For enquiries, please call the Bank’s Customer Service Hotline at 223 95559.

Note: Nina Tower Wealth Management Centre Mon - Fri : 11:00am- 7:00pm

Sat : 11:00am - 3:00pm

2022-04-12

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Kowloon | |

| Tokwawan Branch |

Shop 1-3, G/F., Ocean Mansion, 370-376 Ma Tau Wai Road, Tokwawan, Kowloon |

| Jordan Road Branch |

1/F., Booman Building, 37U Jordan Road, Kowloon |

| New Territories | |

| Tai Po Branch |

Shop No. 1, 2, 26 & 27, G/F., Wing Fai Plaza, 29-35 Ting Kok Road, Tai Po, New Territories |

| From 5 March (Saturday), services of all branches will be suspended on Saturday until further notice. | |

Business hours of retail branches will remain as Monday to Friday 9:00 am to 4:00 pm. The cut-off time of Cheque Deposit at our ATM machine will be adjusted to 4:00 pm from Monday to Friday. Cheques deposited after the cut-off time will be processed on the following clearing day.

The Bank has been taking precautionary measures prudently at all branches, including more frequent deep cleaning and disinfection of branch premises on top of the regular daily cleaning schedule, all employees are requested to measure their body temperature before work and to put on surgical masks at work. The Bank always reminds its staff to regularly wash and sanitise their hands. Staff of the Bank would help customers to check body temperature when entering the branches and customers are encouraged to put on surgical masks. Hand sanitizer is offered in branches for use, if needed.

2022-04-08

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Kowloon | |

| Jordan Road Branch |

1/F., Booman Building, 37U Jordan Road, Kowloon |

| Branch Name | Address |

| Hong Kong Island | |

| West Point Branch | G/F., 327-333 Queen's Road West, Hong Kong |

| New Territories | |

| Nina Tower Wealth Management Centre |

Suite 2304 on 23/F, Tower 2, Nina Tower, No. 8, Yeung Uk Road, Tsuen Wan, New Territories |

| Branch Name | Address |

| Kowloon | |

| Tokwawan Branch |

Shop 1-3, G/F., Ocean Mansion, 370-376 Ma Tau Wai Road, Tokwawan, Kowloon |

| New Territories | |

| Tai Po Branch |

Shop No. 1, 2, 26 & 27, G/F., Wing Fai Plaza, 29-35 Ting Kok Road, Tai Po, New Territories |

| From 5 March (Saturday), services of all branches will be suspended on Saturday until further notice. | |

Business hours of retail branches will remain as Monday to Friday 9:00 am to 4:00 pm. The cut-off time of Cheque Deposit at our ATM machine will be adjusted to 4:00 pm from Monday to Friday. Cheques deposited after the cut-off time will be processed on the following clearing day.

The Bank has been taking precautionary measures prudently at all branches, including more frequent deep cleaning and disinfection of branch premises on top of the regular daily cleaning schedule, all employees are requested to measure their body temperature before work and to put on surgical masks at work. The Bank always reminds its staff to regularly wash and sanitise their hands. Staff of the Bank would help customers to check body temperature when entering the branches and customers are encouraged to put on surgical masks. Hand sanitizer is offered in branches for use, if needed.

Notice on Bank of Communications (Hong Kong) Branch Services

Bank of Communications (Hong Kong) Limited was informed by one employee on 8 April (Friday) that he has preliminarily tested positive for COVID-19. The concerned branch is Jordan Road Branch. The Branch has been temporarily closed since 8 April (Friday) until further notice. Meanwhile, the Bank has already taken corresponding measures, including deep cleaning and disinfecting the Branch premises, all employees at the Branch will conduct viral testing and home quarantine.

Details of the concerned branch and the last working day of this employee is as follows:

| Branch Name | Address | Last Working Day of the Employee |

| Jordan Road Branch |

1/F., Booman Building, 37U Jordan Road, Kowloon | 6 April (Wednesday) |

Bank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. The prudent precautionary measures are implemented in all branches, including enhancing disinfection and cleaning, all employees are requested to measure their body temperature before work, to put on surgical masks at work and maintain social distancing, and the Bank arranges flexible working arrangements. Employees will check customers’ body temperature when entering the branches, and customers are encouraged to put on surgical masks. Hand sanitizer is available in branches for use, if needed.

For enquiries, please call the Bank’s Customer Service Hotline at 223 95559.

2022-04-06

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Kowloon | |

| Tokwawan Branch |

Shop 1-3, G/F., Ocean Mansion, 370-376 Ma Tau Wai Road, Tokwawan, Kowloon |

| New Territories | |

| Tai Po Branch |

Shop No. 1, 2, 26 & 27, G/F., Wing Fai Plaza, 29-35 Ting Kok Road, Tai Po, New Territories |

| Branch Name | Address |

| Hong Kong Island | |

| North Point Branch | Shops Nos. 1-4 on G/F., Maylun Apartments, 442-456 King's Road, North Point, Hong Kong |

| Portion B of Shop 13, G/F, King's Tower, No. 480 King's Road, North Point, Hong Kong | |

| Kowloon | |

| Ngau Tau Kok Branch | Shop G1 & G2, G/F., Phase I, Amoy Plaza, 77 Ngau Tau Kok Road, Kowloon |

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon |

| New Territories | |

| Fanling Branch | Shop No. 84A-84B, G/F., Flora Plaza, Fanling, New Territories |

| Branch Name | Address |

| Hong Kong Island | |

| West Point Branch | G/F., 327-333 Queen's Road West, Hong Kong |

| New Territories | |

| Nina Tower Wealth Management Centre |

Suite 2304 on 23/F, Tower 2, Nina Tower, No. 8, Yeung Uk Road, Tsuen Wan, New Territories |

| From 5 March (Saturday), services of all branches will be suspended on Saturday until further notice. | |

Business hours of retail branches will remain as Monday to Friday 9:00 am to 4:00 pm. The cut-off time of Cheque Deposit at our ATM machine will be adjusted to 4:00 pm from Monday to Friday. Cheques deposited after the cut-off time will be processed on the following clearing day.

The Bank has been taking precautionary measures prudently at all branches, including more frequent deep cleaning and disinfection of branch premises on top of the regular daily cleaning schedule, all employees are requested to measure their body temperature before work and to put on surgical masks at work. The Bank always reminds its staff to regularly wash and sanitise their hands. Staff of the Bank would help customers to check body temperature when entering the branches and customers are encouraged to put on surgical masks. Hand sanitizer is offered in branches for use, if needed.

Notice on Bank of Communications (Hong Kong) Branch Services

Bank of Communications (Hong Kong) Limited was informed by two employees on 6 April (Wednesday) that they have preliminarily tested positive for COVID-19. The concerned branches are Tokwawan Branch and Tai Po Branch. The Branches have been temporarily closed since 6 April (Wednesday) until further notice. Meanwhile, the Bank has already taken corresponding measures, including deep cleaning and disinfecting the Branch premises, all employees at the Branch will conduct viral testing and home quarantine.

Details of the concerned branches and the last working days of these employees are as follows:

| Branch Name | Address | Last Working Day of the Employee |

| Tokwawan Branch |

Shop 1-3, G/F., Ocean Mansion, 370-376 Ma Tau Wai Road, Tokwawan, Kowloon | 4 April (Monday) |

| Tai Po Branch |

Shop No.1, 2, 26 & 27, G/F., Wing Fai Plaza, 29-35 Ting Kok Road, Tai Po, New Territories | 4 April (Monday) |

Bank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. The prudent precautionary measures are implemented in all branches, including enhancing disinfection and cleaning, all employees are requested to measure their body temperature before work, to put on surgical masks at work and maintain social distancing, and the Bank arranges flexible working arrangements. Employees will check customers’ body temperature when entering the branches, and customers are encouraged to put on surgical masks. Hand sanitizer is available in branches for use, if needed.

For enquiries, please call the Bank’s Customer Service Hotline at 223 95559.

2022-04-01

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| New Territories | |

| Nina Tower Wealth Management Centre |

Suite 2304 on 23/F, Tower 2, Nina Tower, No. 8, Yeung Uk Road, Tsuen Wan, New Territories |

| Branch Name | Address |

| New Territories | |

| Tuen Mun Branch | Shops 7-8 on G/F, Castle Peak Lin Won Building, 2-4 Yan Ching Street, Tuen Mun, New Territories |

| Branch Name | Address |

| Hong Kong Island | |

| North Point Branch | Shops Nos. 1-4 on G/F., Maylun Apartments, 442-456 King's Road, North Point, Hong Kong |

| Portion B of Shop 13, G/F, King's Tower, No. 480 King's Road, North Point, Hong Kong | |

| West Point Branch | G/F., 327-333 Queen's Road West, Hong Kong |

| Kowloon | |

| Ngau Tau Kok Branch | Shop G1 & G2, G/F., Phase I, Amoy Plaza, 77 Ngau Tau Kok Road, Kowloon |

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon |

| New Territories | |

| Fanling Branch | Shop No. 84A-84B, G/F., Flora Plaza, Fanling, New Territories |

| From 5 March (Saturday), services of all branches will be suspended on Saturday until further notice. | |

Business hours of retail branches will remain as Monday to Friday 9:00 am to 4:00 pm. The cut-off time of Cheque Deposit at our ATM machine will be adjusted to 4:00 pm from Monday to Friday. Cheques deposited after the cut-off time will be processed on the following clearing day.

The Bank has been taking precautionary measures prudently at all branches, including more frequent deep cleaning and disinfection of branch premises on top of the regular daily cleaning schedule, all employees are requested to measure their body temperature before work and to put on surgical masks at work. The Bank always reminds its staff to regularly wash and sanitise their hands. Staff of the Bank would help customers to check body temperature when entering the branches and customers are encouraged to put on surgical masks. Hand sanitizer is offered in branches for use, if needed.

Notice on Bank of Communications (Hong Kong) Branch Services

Bank of Communications (Hong Kong) Limited was informed by one employee on 1 April (Friday) that she has preliminarily tested positive for COVID-19. The concerned branch is Nina Tower Wealth Management Centre. The Branch has been temporarily closed since 1 April (Friday) until further notice. Meanwhile, the Bank has already taken corresponding measures, including deep cleaning and disinfecting the Branch premises, all employees at the Branch will conduct viral testing and home quarantine.

Details of the concerned branch and the last working day of this employee is as follows:

| Branch Name | Address | Last Working Day of the Employee |

| Nina Tower Wealth Management Centre |

Suite 2304 on 23/F, Tower 2, Nina Tower, No. 8, Yeung Uk Road, Tsuen Wan, New Territories | 31 March (Thursday) |

Bank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. The prudent precautionary measures are implemented in all branches, including enhancing disinfection and cleaning, all employees are requested to measure their body temperature before work, to put on surgical masks at work and maintain social distancing, and the Bank arranges flexible working arrangements. Employees will check customers’ body temperature when entering the branches, and customers are encouraged to put on surgical masks. Hand sanitizer is available in branches for use, if needed.

For enquiries, please call the Bank’s Customer Service Hotline at 223 95559.

2022-03-31

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Hong Kong Island | |

| Taikoo Shing Branch | Shop 38, G/F., CityPlaza 2, 18 Taikoo Shing Road, Hong Kong |

| New Territories | |

| Ma On Shan Branch | Shop Nos. 303-304, Level 3, Ma On Shan Plaza, 608 Sai Sha Road, Ma On Shan, New Territories |

| Sha Tsui Road Branch | Shops Nos. 3-5 on G/F., Kwong Ming Building, 120-130 Sha Tsui Road, Tsuen Wan, New Territories |

| Branch Name | Address |

| Hong Kong Island | |

| North Point Branch | Shops Nos. 1-4 on G/F., Maylun Apartments, 442-456 King's Road, North Point, Hong Kong |

| Portion B of Shop 13, G/F, King's Tower, No. 480 King's Road, North Point, Hong Kong | |

| West Point Branch | G/F., 327-333 Queen's Road West, Hong Kong |

| Kowloon | |

| Ngau Tau Kok Branch | Shop G1 & G2, G/F., Phase I, Amoy Plaza, 77 Ngau Tau Kok Road, Kowloon |

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon |

| New Territories | |

| Fanling Branch | Shop No. 84A-84B, G/F., Flora Plaza, Fanling, New Territories |

| Tuen Mun Branch | Shops 7-8 on G/F, Castle Peak Lin Won Building, 2-4 Yan Ching Street, Tuen Mun, New Territories |

| From 5 March (Saturday), services of all branches will be suspended on Saturday until further notice. | |

Business hours of retail branches will remain as Monday to Friday 9:00 am to 4:00 pm. The cut-off time of Cheque Deposit at our ATM machine will be adjusted to 4:00 pm from Monday to Friday. Cheques deposited after the cut-off time will be processed on the following clearing day.

The Bank has been taking precautionary measures prudently at all branches, including more frequent deep cleaning and disinfection of branch premises on top of the regular daily cleaning schedule, all employees are requested to measure their body temperature before work and to put on surgical masks at work. The Bank always reminds its staff to regularly wash and sanitise their hands. Staff of the Bank would help customers to check body temperature when entering the branches and customers are encouraged to put on surgical masks. Hand sanitizer is offered in branches for use, if needed.

BOCOM(HK)(the “Bank”) 2022 Mobile Banking Year of the Tiger Lottery Result Announcement

We hereby announce the winners list. For the winners list, please click here.

All rewards will be credited to the winners’ savings deposit or current deposit account of the Bank by 31st March 2022. Whichever account being credited to is subject to the Bank’s absolute discretion. The winners must be holding the Bank’s savings deposit or current deposit account and satisfy the transaction requirement(s) when the Bank credits the rewards, if not, the eligibility of the winners will be cancelled.

If you have any questions on this promotion campaign, please contact our staff of your designated branch.

2022-03-30

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Hong Kong Island | |

| Hennessy Road Branch | G/F., Bank of Communications Building., 368 Hennessy Road, Hong Kong |

| Branch Name | Address |

| Hong Kong Island | |

| Taikoo Shing Branch | Shop 38, G/F., CityPlaza 2, 18 Taikoo Shing Road, Hong Kong |

| North Point Branch | Shops Nos. 1-4 on G/F., Maylun Apartments, 442-456 King's Road, North Point, Hong Kong |

| Portion B of Shop 13, G/F, King's Tower, No. 480 King's Road, North Point, Hong Kong | |

| West Point Branch | G/F., 327-333 Queen's Road West, Hong Kong |

| Kowloon | |

| Ngau Tau Kok Branch | Shop G1 & G2, G/F., Phase I, Amoy Plaza, 77 Ngau Tau Kok Road, Kowloon |

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon |

| New Territories | |

| Ma On Shan Branch | Shop Nos. 303-304, Level 3, Ma On Shan Plaza, 608 Sai Sha Road, Ma On Shan, New Territories |

| Sha Tsui Road Branch | Shops Nos. 3-5 on G/F., Kwong Ming Building, 120-130 Sha Tsui Road, Tsuen Wan, New Territories |

| Fanling Branch | Shop No. 84A-84B, G/F., Flora Plaza, Fanling, New Territories |

| Tuen Mun Branch | Shops 7-8 on G/F, Castle Peak Lin Won Building, 2-4 Yan Ching Street, Tuen Mun, New Territories |

| From 5 March (Saturday), services of all branches will be suspended on Saturday until further notice. | |

Business hours of retail branches will remain as Monday to Friday 9:00 am to 4:00 pm. The cut-off time of Cheque Deposit at our ATM machine will be adjusted to 4:00 pm from Monday to Friday. Cheques deposited after the cut-off time will be processed on the following clearing day.

The Bank has been taking precautionary measures prudently at all branches, including more frequent deep cleaning and disinfection of branch premises on top of the regular daily cleaning schedule, all employees are requested to measure their body temperature before work and to put on surgical masks at work. The Bank always reminds its staff to regularly wash and sanitise their hands. Staff of the Bank would help customers to check body temperature when entering the branches and customers are encouraged to put on surgical masks. Hand sanitizer is offered in branches for use, if needed.

2022-03-29

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Kowloon | |

| Hunghom Branch | Shop A6, G/F., Whampoa Estate Planet Square, 1-3 Tak Man Street, Kowloon |

| New Territories | |

| Tin Shui Wai Branch | Shop No. G72, G/F, +WOO (Phase 1), 12-18 Tin Yan Road, Tin Shui Wai, New Territories |

| Branch Name | Address |

| Hong Kong Island | |

| Hennessy Road Branch | G/F., Bank of Communications Building., 368 Hennessy Road, Hong Kong |

| Taikoo Shing Branch | Shop 38, G/F., CityPlaza 2, 18 Taikoo Shing Road, Hong Kong |

| North Point Branch | Shops Nos. 1-4 on G/F., Maylun Apartments, 442-456 King's Road, North Point, Hong Kong |

| Portion B of Shop 13, G/F, King's Tower, No. 480 King's Road, North Point, Hong Kong | |

| West Point Branch | G/F., 327-333 Queen's Road West, Hong Kong |

| Kowloon | |

| Ngau Tau Kok Branch | Shop G1 & G2, G/F., Phase I, Amoy Plaza, 77 Ngau Tau Kok Road, Kowloon |

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon |

| New Territories | |

| Ma On Shan Branch | Shop Nos. 303-304, Level 3, Ma On Shan Plaza, 608 Sai Sha Road, Ma On Shan, New Territories |

| Sha Tsui Road Branch | Shops Nos. 3-5 on G/F., Kwong Ming Building, 120-130 Sha Tsui Road, Tsuen Wan, New Territories |

| Fanling Branch | Shop No. 84A-84B, G/F., Flora Plaza, Fanling, New Territories |

| Tuen Mun Branch | Shops 7-8 on G/F, Castle Peak Lin Won Building, 2-4 Yan Ching Street, Tuen Mun, New Territories |

| From 5 March (Saturday), services of all branches will be suspended on Saturday until further notice. | |

Business hours of retail branches will remain as Monday to Friday 9:00 am to 4:00 pm. The cut-off time of Cheque Deposit at our ATM machine will be adjusted to 4:00 pm from Monday to Friday. Cheques deposited after the cut-off time will be processed on the following clearing day.

The Bank has been taking precautionary measures prudently at all branches, including more frequent deep cleaning and disinfection of branch premises on top of the regular daily cleaning schedule, all employees are requested to measure their body temperature before work and to put on surgical masks at work. The Bank always reminds its staff to regularly wash and sanitise their hands. Staff of the Bank would help customers to check body temperature when entering the branches and customers are encouraged to put on surgical masks. Hand sanitizer is offered in branches for use, if needed.

2022-03-28

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Hong Kong Island | |

| West Point Branch | G/F., 327-333 Queen's Road West, Hong Kong |

| Kowloon | |

| Hunghom Branch | Shop A6, G/F., Whampoa Estate Planet Square, 1-3 Tak Man Street, Kowloon |

| Branch Name | Address |

| Hong Kong Island | |

| Kennedy Town Branch | G/F., 113-119 Belcher's Street, Kennedy Town, Hong Kong |

| Kowloon | |

| Cheung Sha Wan Plaza Branch | Unit G04 on G/F., Cheung Sha Wan Plaza, 833 Cheung Sha Wan Road, Kowloon |

| New Territories | |

| Tiu Keng Leng Branch | Shops Nos. L2-064 and L2- 065, Level 2, Metro Town, Tiu Keng Leng, New Territories |

| Shatin City One Branch | Shop 188, 1/F., Fortune City One, City One Shatin, New Territories |

| Branch Name | Address |

| Hong Kong Island | |

| Hennessy Road Branch | G/F., Bank of Communications Building., 368 Hennessy Road, Hong Kong |

| Taikoo Shing Branch | Shop 38, G/F., CityPlaza 2, 18 Taikoo Shing Road, Hong Kong |

| North Point Branch | Shops Nos. 1-4 on G/F., Maylun Apartments, 442-456 King's Road, North Point, Hong Kong |

| Portion B of Shop 13, G/F, King's Tower, No. 480 King's Road, North Point, Hong Kong | |

| Kowloon | |

| Ngau Tau Kok Branch | Shop G1 & G2, G/F., Phase I, Amoy Plaza, 77 Ngau Tau Kok Road, Kowloon |

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon |

| New Territories | |

| Tin Shui Wai Branch | Shop No. G72, G/F, +WOO (Phase 1), 12-18 Tin Yan Road, Tin Shui Wai, New Territories |

| Ma On Shan Branch | Shop Nos. 303-304, Level 3, Ma On Shan Plaza, 608 Sai Sha Road, Ma On Shan, New Territories |

| Sha Tsui Road Branch | Shops Nos. 3-5 on G/F., Kwong Ming Building, 120-130 Sha Tsui Road, Tsuen Wan, New Territories |

| Fanling Branch | Shop No. 84A-84B, G/F., Flora Plaza, Fanling, New Territories |

| Tuen Mun Branch | Shops 7-8 on G/F, Castle Peak Lin Won Building, 2-4 Yan Ching Street, Tuen Mun, New Territories |

| From 5 March (Saturday), services of all branches will be suspended on Saturday until further notice. | |

Business hours of retail branches will remain as Monday to Friday 9:00 am to 4:00 pm. The cut-off time of Cheque Deposit at our ATM machine will be adjusted to 4:00 pm from Monday to Friday. Cheques deposited after the cut-off time will be processed on the following clearing day.

The Bank has been taking precautionary measures prudently at all branches, including more frequent deep cleaning and disinfection of branch premises on top of the regular daily cleaning schedule, all employees are requested to measure their body temperature before work and to put on surgical masks at work. The Bank always reminds its staff to regularly wash and sanitise their hands. Staff of the Bank would help customers to check body temperature when entering the branches and customers are encouraged to put on surgical masks. Hand sanitizer is offered in branches for use, if needed.

Notice on Bank of Communications (Hong Kong) Branch Services

Bank of Communications (Hong Kong) Limited was informed by two employees on 27 March (Sunday) and 28 March (Monday) that they have preliminarily tested positive for COVID-19. The concerned branches are West Point Branch and Hunghom Branch. The Branches have been temporarily closed since 28 March (Monday) until further notice. Meanwhile, the Bank has already taken corresponding measures, including deep cleaning and disinfecting the Branch premises, all employees at the Branches will conduct viral testing and home quarantine.

Details of the concerned branches and the last working days of these employees are as follows:

| Branch Name | Address | Last Working Day of the Employee |

| West Point Branch | G/F., 327-333 Queen's Road West, Hong Kong | 25 March (Friday) |

| Hunghom Branch | Shop A6, G/F., Whampoa Estate Planet Square, 1-3 Tak Man Street, Kowloon | 25 March (Friday) |

Bank of Communications (Hong Kong) Limited holds the health and safety of our customers and employees in the highest regard. The prudent precautionary measures are implemented in all branches, including enhancing disinfection and cleaning, all employees are requested to measure their body temperature before work, to put on surgical masks at work and maintain social distancing, and the Bank arranges flexible working arrangements. Employees will check customers’ body temperature when entering the branches, and customers are encouraged to put on surgical masks. Hand sanitizer is available in branches for use, if needed.

For enquiries, please call the Bank’s Customer Service Hotline at 223 95559.

2022-03-25

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| Hong Kong Island | |

| Quarry Bay Branch | Shops 2, G/F., No. 1001 King's Road, Quarry Bay, Hong Kong |

| Business Department | Unit B B/F & G/F, Unit C G/F, Wheelock House, 20 Pedder Street, Central, Hong Kong |

| Branch Name | Address |

| Hong Kong Island | |

| Kennedy Town Branch | G/F., 113-119 Belcher's Street, Kennedy Town, Hong Kong |

| Hennessy Road Branch | G/F., Bank of Communications Building., 368 Hennessy Road, Hong Kong |

| Taikoo Shing Branch | Shop 38, G/F., CityPlaza 2, 18 Taikoo Shing Road, Hong Kong |

| North Point Branch | Shops Nos. 1-4 on G/F., Maylun Apartments, 442-456 King's Road, North Point, Hong Kong |

| Portion B of Shop 13, G/F, King's Tower, No. 480 King's Road, North Point, Hong Kong | |

| Kowloon | |

| Cheung Sha Wan Plaza Branch | Unit G04 on G/F., Cheung Sha Wan Plaza, 833 Cheung Sha Wan Road, Kowloon |

| Ngau Tau Kok Branch | Shop G1 & G2, G/F., Phase I, Amoy Plaza, 77 Ngau Tau Kok Road, Kowloon |

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon |

| New Territories | |

| Tin Shui Wai Branch | Shop No. G72, G/F, +WOO (Phase 1), 12-18 Tin Yan Road, Tin Shui Wai, New Territories |

| Tiu Keng Leng Branch | Shops Nos. L2-064 and L2- 065, Level 2, Metro Town, Tiu Keng Leng, New Territories |

| Shatin City One Branch | Shop 188, 1/F., Fortune City One, City One Shatin, New Territories |

| Ma On Shan Branch | Shop Nos. 303-304, Level 3, Ma On Shan Plaza, 608 Sai Sha Road, Ma On Shan, New Territories |

| Sha Tsui Road Branch | Shops Nos. 3-5 on G/F., Kwong Ming Building, 120-130 Sha Tsui Road, Tsuen Wan, New Territories |

| Fanling Branch | Shop No. 84A-84B, G/F., Flora Plaza, Fanling, New Territories |

| Tuen Mun Branch | Shops 7-8 on G/F, Castle Peak Lin Won Building, 2-4 Yan Ching Street, Tuen Mun, New Territories |

| From 5 March (Saturday), services of all branches will be suspended on Saturday until further notice. | |

Business hours of retail branches will remain as Monday to Friday 9:00 am to 4:00 pm. The cut-off time of Cheque Deposit at our ATM machine will be adjusted to 4:00 pm from Monday to Friday. Cheques deposited after the cut-off time will be processed on the following clearing day.

The Bank has been taking precautionary measures prudently at all branches, including more frequent deep cleaning and disinfection of branch premises on top of the regular daily cleaning schedule, all employees are requested to measure their body temperature before work and to put on surgical masks at work. The Bank always reminds its staff to regularly wash and sanitise their hands. Staff of the Bank would help customers to check body temperature when entering the branches and customers are encouraged to put on surgical masks. Hand sanitizer is offered in branches for use, if needed.

2022-03-24

Bank of Communications (Hong Kong) Announces Branch Service Change Update| Branch Name | Address |

| New Territories | |

| Tuen Mun Branch | Shops 7-8 on G/F, Castle Peak Lin Won Building, 2-4 Yan Ching Street, Tuen Mun, New Territories |

| Branch Name | Address |

| Hong Kong Island | |

| Shau Kei Wan Branch | Shop 2-3, G/F., Tung Fai Building, 161-165 Shau Kei Wan Main Street East, Hong Kong |

| New Territories | |

| Sam Shing Estate Branch | Shop No. 4, G/F., Moon Yu House, Sam Shing Estate, 6 Sam Shing Street, Tuen Mun, New Territories |

| Branch Name | Address |

| Hong Kong Island | |

| Kennedy Town Branch | G/F., 113-119 Belcher's Street, Kennedy Town, Hong Kong |

| Quarry Bay Branch | Shops 2, G/F., No. 1001 King's Road, Quarry Bay, Hong Kong |

| Hennessy Road Branch | G/F., Bank of Communications Building., 368 Hennessy Road, Hong Kong |

| Business Department | Unit B B/F & G/F, Unit C G/F, Wheelock House, 20 Pedder Street, Central, Hong Kong |

| Taikoo Shing Branch | Shop 38, G/F., CityPlaza 2, 18 Taikoo Shing Road, Hong Kong |

| North Point Branch | Shops Nos. 1-4 on G/F., Maylun Apartments, 442-456 King's Road, North Point, Hong Kong |

| Portion B of Shop 13, G/F, King's Tower, No. 480 King's Road, North Point, Hong Kong | |

| Kowloon | |

| Cheung Sha Wan Plaza Branch | Unit G04 on G/F., Cheung Sha Wan Plaza, 833 Cheung Sha Wan Road, Kowloon |

| Ngau Tau Kok Branch | Shop G1 & G2, G/F., Phase I, Amoy Plaza, 77 Ngau Tau Kok Road, Kowloon |

| Jordan Road Branch | 1/F., Booman Building, 37U Jordan Road, Kowloon |

| New Territories | |