" Securities Trading Order " Frequently Asked Questions and Answers

- What is enhanced limit order?

- What is At-auction limit order ?

- Does enhanced limit order & At-auction limit order have limit for input price?

- What is Trigger Order?

" Pre-opening Session (POS) " Frequently Asked Questions and Answers

- What is a Pre-opening Session (POS)?

- What securities are covered under the POS ?

- Is there any restriction for the Order Types and Price Limits for the POS?

- How does the POS work?

" Closing Auction Session (CAS) " Frequently Asked Questions and Answers

- What is a Closing Auction Session (CAS)?

- What securities are covered under CAS?

- How the restriction for the Order Types and Price Limits for the CAS?

- How does the CAS work?

" Volatility Control Mechanism (VCM) " Frequently Asked Questions and Answers

- What is the Volatility Control Mechanism (VCM)?

- What instruments are covered under the VCM?

- How does the VCM model work?

- What is the applicable period for VCM monitoring?

- What is the VCM arrangement with respect to adverse weather?

- Can VCM be triggered on an applicable instrument multiple times in a trading day?

"Securities Mobile Application" Frequently Asked Questions and Answers

- What is Securities Mobile Application?

- What kind of person can use Securities Mobile Application?

- What functions are offered by Securities Mobile Application?

- Does Securities Mobile Application support 24 hours order placing service?

- Can I use Securities Mobile Application to sell odd lot shares?

- How to download Securities Mobile Application?

- Is this service free of charge?

- Can I access Securities Mobile App on any mobile handsets?

"IPO Services"Frequently asked Questions and Answers

"Monthly stocks Investment Plan" Frequently Asked Questions and Answers

- What are the usual forms and documents for "Monthly Stocks Investment Plan"?

- What does "Monthly Stocks Investment Plan" stand for?

- How many securities are available for selection in "Monthly Stocks Investment Plan"?

- What is the minimum investment amount required for "Monthly Stocks Investment Plan" ?

- How much does "Monthly Stocks Investment Plan" charge for?

- How can I subscribe to "Monthly Stocks Investment Plan" ?

- When will my "Monthly Stocks Investment Plan" application come into effect?

- How do I make the "Monthly Stocks Investment Plan" contribution?

- When will Bank of Communications purchase stocks for me each month ?

- How can I check my securities purchase price and number of stock purchased?

- How does Bank of Communications handle my stock(s) purchased and residual investment amount?

- How can I sell my "Monthly Stocks Investment Plan" stock(s)?

- How can I adjust my "Monthly Stocks Investment Plan" portfolio?

- Do I need to re-apply the Direct Debit Authorization after I have adjusted my "Monthly Stocks Investment Plan" portfolio?

- When will the amendment come into effect?

- Can I terminate the plan?

- Do I enjoy the dividend payments?

" Two-factor Authentication " Frequently Asked Questions and Answers

" One-time Password " Frequently Asked Questions and Answers

- What is a one-time password?

- When do I use a one-time password?

- What should I do if I receive an SMS containing a one-time password on my mobile phone but am not performing any internet banking transactions?

- Is there any charge for using one-time password?

- How to register or update the mobile phone number for receiving the One-time-password?

- Do I need to go to any Outlets of your Bank to register for one-time password?

- Do I need to enroll the service for receiving SMS messages with telecommunication companies in order to receive SMS messages?

"Mobile Authentication" Frequently Asked Questions and Answers

- What is a Mobile Authentication?

- What are the benefits of the Mobile Authentication?

- Are there any charges for Mobile Authentication?

- How do I activate the Mobile Authentication on my mobile device?

- Can I have a Mobile Authentication on more than one device?

- Which mobile phones can activate Mobile Authentication?

- Can I use "Mobile Authentication" and "Security Device" at the same time?

- What happens if I want to stop using my Mobile Authentication activated mobile device?

- What happens if my Mobile Authentication activated device is lost or stolen?

- What should I do if I have changed the SIM card or mobile phone number on my Mobile Authentication activated mobile device?

- Why do I have to set up a Mobile Authentication password?

- What if I forgot my Mobile Authentication password?

- Can I change my Mobile Authentication password in the future?

- Do I have to use my Mobile Authentication password every time I log on to BOCOM(HK) Securities Mobile App Service?

- Can others use my Mobile Authentication activated device to log on to their Securities Mobile App?

- Can I use someone else's device as my Mobile Security Key if I don't have my own device with me?

- I have activated Mobile Authentication on a jailbroken/rooted device earlier, but I could no longer access the mobile app anymore, what should I do?

"Touch ID/Fingerprint Authentication" Frequently Asked Questions and Answers

- What is Touch ID/Fingerprint Authentication?

- Which devices is Touch ID/Fingerprint available on?

- Is Touch ID/ Fingerprint Authentication safe?

- How can I set up my Touch ID for the BOCOM(HK) Securities Mobile App?

- What happens if I change my Touch ID/ Fingerprint Authentication settings?

- If my fingerprint is not recognised, can I still log on to my account using my Mobile Authentication password?

- Can someone else log on to the BOCOM (HK) Securities Mobile App services if their fingerprint is stored on my device?

- How can I disable Touch ID/ Fingerprint Authentication in the BOCOM(HK) Securities Mobile App?

- What if my Touch ID/Fingerprint Authentication enabled device is lost or stolen?

- Where will my fingerprints be stored?

"Face ID" Frequently Asked Questions and Answers

- What is Face ID?

- Which devices is Face ID available on?

- Should I enable "Face ID " if my siblings and I look alike or I am an adolescent?

- Is Face ID safe?

- How can I set up my Face ID for the BOCOM(HK) Securities Mobile App?

- What happens if I change my Face ID settings?

- If my face is not recognised, can I still log on to my account using my Mobile Security Key password?

- Can someone else log on to the BOCOM (HK) Securities Mobile App services if their facial map is stored on my device?

- How can I disable Face ID in the BOCOM(HK) Securities Mobile App?

- What if my Face ID enabled device is lost or stolen?

- Where will my facial map be stored?

- If I selected "Don't allow" when asked whether I wanted to set up Face ID for the BOCOM(HK) Securities Mobile App, can I enable it again later?

“Reply Corporate Actions” Frequently Asked Questions and Answers

- What are the Corporate Action events supported by Internet/ Securities Mobile Application platform?

- Why the Corporate Action that I am entitled did not show in the "Corporate Actions" page?

- Can I submit a instruction via Internet/ Securities Mobile Application in advance of an expected corporate action?

- What is the meaning of the status in Corporate Action?

- Why historical Corporate Action Events are not showing on Internet/ Securities Mobile Application?

"Internet / Securities Mobile Application Portfolio Instant Gain and Loss Display Function" Frequently Asked Questions and Answers

- What is Internet / Securities Mobile Application Portfolio Instant Gain and Loss Display Function?

- What is Instant Gain and Loss Calculation?

- Which devices is the Internet / Securities Mobile Application Portfolio Instant Gain and Loss Display Function available on and any charges for this function?

- Which stock market is available for the Internet / Securities Mobile Application Portfolio Instant Gain and Loss Display Function?

"Securities Mobile Application AI Stock Filter Function" Frequently Asked Questions and Answers

- What is AI Stock Filter Function?

- How to use the AI Stock Filter Function?

- Which device is required for AI Stock Filter? Any charge for this function?

- Which stock markets are available for the AI Stock Filter?

" Securities Trading Order " Frequently Asked Questions and Answers

“Pre-opening Session (POS)” Frequently Asked Questions and Answers

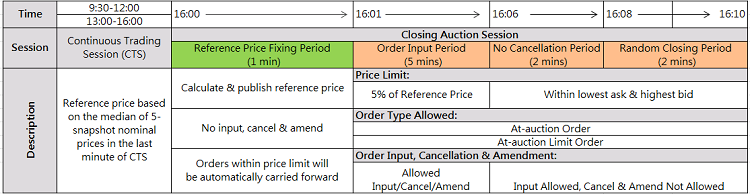

"Closing Auction Session (CAS)" Frequently Asked Questions and Answers

1. |

HKEX launches CAS on 25 July 2016. For the securities markets, the market closing time will change from 16:00 to a random closing of anytime between 16:08 and 16:10 for a normal trading day. It will change from 12:00 to a random closing of anytime between 12:08 and 12:10 for a half day trading. There would be CAS in half trading days as well, so that trading hours of the CAS Securities would be extended accordingly.

|

|||||||||||||||

2. |

|

|||||||||||||||

3. |

|

|||||||||||||||

4. |

* There would be CAS in half trading days as well, so that trading hours of the CAS Securities would be extended accordingly. Sources: Hong Kong Stock Exchange (HKEx) |

“Volatility Control Mechanism (VCM)" Frequently Asked Questions and Answers

1. |

What is the Volatility Control Mechanism (VCM)? The Volatility Control Mechanism is designed to prevent extreme price volatility from trading incidents such as a “flash crash” and algorithm errors, and to address systemic risks from the inter-connectedness of securities and derivatives markets. Many international exchanges have implemented some form of VCM. In the case of HKEX's VCM, if the price deviates more than a predefined percentage within a specific time frame, it will trigger a cooling-off period for five minutes. This provides a window allowing market participants to reassess their strategies, if necessary. It also helps to re-establish an orderly market during volatile market situations. |

2. |

What instruments are covered under the VCM? In the securities market, VCM will only be applied to Hang Seng Index (HSI) and Hang Seng China Enterprises Index (HSCEI) constituent stocks (together the VCM securities). Please refer the list of VCM Securities in HKEX websites. |

3. |

How does the VCM model work? HKEX has adopted a dynamic price limit VCM model for the securities and derivatives markets, which would trigger a cooling-off period in case of abrupt price volatility detected at the instrument level.

|

4. |

What is the applicable period for VCM monitoring? VCM monitoring is applicable to continuous trading session (CTS), excluding:

* Since a cooling-off period will last for 5 minutes, the monitoring will stop 20 minutes before end of the Afternoon Session |

5. |

What is the VCM arrangement with respect to adverse weather? Delay Open of Securities Market due to Bad Weather In the case that market open is delayed due to bad weather (e.g. hoisting of typhoon signal no.8 or above or issuance of black rainstorm warning), similar to the normal market open, the first 15 minutes after market open will not be subject to the VCM monitoring. Early Close of Securities Market due to Bad Weather In the case of an early close of the market due to bad weather (e.g. hoisting of typhoon signal no.8 or above during trading hours), cooling-off period can still be triggered in the last 15 minutes before market close and can continue until market close. |

6. |

Can VCM be triggered on an applicable instrument multiple times in a trading day? For each VCM instrument, there will be a maximum of one VCM trigger in each trading session (Morning Session and Afternoon Session are counted as two separate trading sessions). When normal trading has been resumed after the VCM, there will not be any VCM monitoring within the same CTS. Sources: Hong Kong Stock Exchange (HKEX) |

"Securities Mobile Application" Frequently Asked Questions and Answers

1. |

What is Securities Mobile Application? With an advanced interface, users can obtain timely market news and capture every investment opportunity. |

||||||||||||||||||||||||||||||||||||||||||||||||||

2. |

What kind of person can use Securities Mobile Application? |

||||||||||||||||||||||||||||||||||||||||||||||||||

3. |

What functions are offered by Securities Mobile Application?

|

||||||||||||||||||||||||||||||||||||||||||||||||||

4. |

Does Securities Mobile Application support 24 hours order placing service? |

||||||||||||||||||||||||||||||||||||||||||||||||||

5. |

Can I use Securities Mobile Application to sell odd lot shares? |

||||||||||||||||||||||||||||||||||||||||||||||||||

6. |

How to download Securities Mobile Application? Securities Mobile Application

Google Play and Google Play logo are trademarks of Google LLC.

|

||||||||||||||||||||||||||||||||||||||||||||||||||

7. |

Is this service free of charge? Yes. However, please check with your telecommunication service provider about data transmission and/or other charges that may apply to using the Internet via your mobile device, particularly traveling outside Hong Kong and using roaming service. |

||||||||||||||||||||||||||||||||||||||||||||||||||

8. |

Can I access Securities Mobile App on any mobile handsets Our Securities Mobile App can support most of the mobile phone using iOS/Android Operating System. Our recommended Operating Systems will be

|

||||||||||||||||||||||||||||||||||||||||||||||||||

"IPO Services" Frequently asked Questions and Answers

1. |

|

2. |

How to get allotment result?

|

"Monthly stocks Investment Plan" Frequently Asked Questions and Answers

1. |

What are the usual forms and documents for "Monthly Stocks Investment Plan"? Monthly Stocks Investment Plan Terms and Conditions Monthly Stocks Investment Plan Application Form Monthly Stocks Investment Plan Alteration/Cancellation Form Monthly Stocks Investment Plan Direct Debit Authorization Form Amendment and/or Revocation of Direct Debit Authorization |

2. |

What does "Monthly Stocks Investment Plan" stand for? "Monthly Stocks Investment Plan" is a regular securities purchase program by investing in certain stocks on monthly basis. |

3. |

|

4. |

What is the minimum investment amount required for "Monthly Stocks Investment Plan" ? The minimum monthly investment amount is HK$1,000. Extra contribution must be in multiples of HK$500. |

5. |

How much does "Monthly Stocks Investment Plan" charge for? You only need to pay a transaction fee for each stock which is 0.25% of the monthly investment amount or HK$50, whichever is higher. The transaction fee has already included brokerage commission, stamp duty, transaction levy and trading fee. |

6. |

How can I subscribe to "Monthly Stocks Investment Plan" ? "Monthly Stocks Investment Plan" is eligible to securities account holder. You simply complete "Monthly Stocks Investment Plan" Application Form and return it in person to any outlets of Bank of Communications or via our online application . |

7. |

When will my "Monthly Stocks Investment Plan" application come into effect? If you submit your "Monthly Stocks Investment Plan" application to any outlets of Bank of Communications, it will come into effect in the following calendar month in case the application is submitted by the 25th day of that month. If you submit your application via online channels, the application will come into effect in the following calendar month even your application is submitted at the last calendar day of that month. |

8. |

How do I make the "Monthly Stocks Investment Plan" contribution? The payment date will be on the sixth day (6th) of each calendar month. Your monthly investment amount will be automatically debited from your Payment Account that you instruct.. If the Payment Date falls on a day other than a Banking Day, the Payment Date shall fall on the next Banking Day. You can choose Bank of Communications Ltd. saving account or credit card for the contribution (The registration name must be the same as that of securities account). |

9. |

When will Bank of Communications purchase stocks for me each month ? Bank of Communications will purchase the stocks on the second trading day after the Payment Date. (e.g. If the Payment Date is 6th (Monday), the stocks will be purchased on 8th (Wednesday).) |

10. |

How can I check my securities purchase price and number of stock purchased? You will receive a daily statement within 2 working days following the Trading date. Securities purchase price and number of stock purchased will be listed on your statement. Calculation of number of stock purchased: {Investment Amount (A) - Transaction Fee (B) } ÷ Securities Purchase Price (C). The number of shares allocated will be rounded down to the nearest whole number of shares. {No. of stock purchased = ( A - B ) ÷C } For example: By investing HK$5,000 in HSBC at the purchase price HK$92 i.e. (HK$5,000 - HK$50)÷HK$92 = 53 shares will be bought and the residual investment amount will be HK$74. |

11. |

How does Bank of Communications handle my stock(s) purchased and residual investment amount? Your stock(s) will be deposited into your security account on the Trading Date. Any residual investment amount will be credited to your security account within 3 banking days following the Trading Date. |

12. |

How can I sell my "Monthly Stocks Investment Plan" stock(s)? You can sell your “Monthly Stocks Investment Plan” stock(s) through our Internet Banking, Automated IVR telephone services, operator assisted hotline or securities counters in outlets. |

13. |

How can I adjust my "Monthly Stocks Investment Plan" portfolio? You can make the adjustment by completing the "Monthly Stocks Investment Plan" Alteration/Cancellation Form and return the form in person to any outlets of Bank of Communications or submit the instruction via our online channels (if applicable). |

14. |

Do I need to re-apply the Direct Debit Authorization after I have adjusted my "Monthly Stocks Investment Plan" portfolio? If the total monthly investment amount of your adjusted "Monthly Stocks Investment Plan" portfolio is same as the previous one, please follow the requirement mentioned in Question 13. If your "Monthly Stocks Investment Plan" is applied at our outlets previously , please fill in the Amendment and/or Revocation of Direct Debit Authorization and send it with "Monthly Stocks Investment Plan" Alteration/Cancellation Form to our bank. |

15. |

When will the amendment come into effect? If you submit your "Monthly Stocks Investment Plan" amendment by the 25th day of that month, it will come into effect in the following calendar month. If you submit your amendment via online channels, the application will come into effect in the following month even your amendment is submitted at the last calendar day of that month. |

16. |

Can I terminate the plan? You can terminate your plan by completing the "Monthly Stocks Investment Plan" Alteration/Cancellation Form and Amendment and/or Revocation of Direct Debit Authorization return the form in person to any outlets of Bank of Communications or submit the termination via our online channels (if applicable). However, the cancellation process will take you one month to become effective upon the receipt of your notice. If your settlement account for Direct Debit Authorization is not offered by Bank of Communications, you need to inform such cancellation to the bank of your settlement account. |

17. |

Do I enjoy the dividend payments? Yes. Upon the purchased stock(s) is/are settled (on “Transaction Date” plus 2 SEHK Trading Days), you will enjoy the same shareholder's rights including dividend payments and bonus shares. |

" Two-factor Authentication " Frequently Asked Questions and Answers

1. |

What is two-factor authentication? Two-factor authentication is an authentication scheme that increases online security by relying on a combination of two different factors, something you know (e.g. user ID and password) and something you have (e.g. mobile phone SIM card) in the verification of a user's identity. |

2. |

|

" One-time Password " Frequently Asked Questions and Answers

1. |

What is a one-time password? A one-time password is an SMS-based password generated by a bank and sent to your registered mobile phone number as an additional form of identity authentication. |

2. |

|

3. |

|

4. |

|

5. |

|

6. |

|

7. |

|

1. |

|

2. |

What are the benefits of the Mobile Authentication? Mobile Authentication has been designed to work as part of the BOCOM(HK) Securities Mobile App on supported operating systems and devices. It can be used as a replacement for your physical Security Device. It means you do not need to carry a physical Security Device with you, and offers a more convenient way to access our full range of securities mobile services. Also, the Mobile Security Key can only be used on your chosen device. This provides you with an additional level of security. |

3. |

Are there any charges for Mobile Authentication? It is free of charge for using Mobile Authentication. |

4. |

How do I activate the Mobile Authentication on my mobile device? Once you have downloaded the BOCOM(HK) Securities Mobile App on your mobile device, you can log on and select "Mobile Authentication" from the main page. Please note that you need to have a valid and up-to-date mobile phone number in our records in order to activate the Mobile Security Key. |

5. |

Can I have a Mobile Authentication on more than one device? For security reasons, your Mobile Authentication can only be registered to one device at a time. If you would like to change the mobile device which your Mobile Authentication is linked to, simply log on to the BOCOM(HK) Securities Mobile App with your new mobile device and select "Mobile Authentication" from the menu. Then select "Reactivate Mobile Authentication" and follow the on-screen instructions. |

6. |

Which mobile phones can activate Mobile Authentication? "You can activate "Mobile Authentication"on mobile phones: - iPhone 5s or higher model with iOS 12.0 or above - Android phone with Android 8.0 or above AND compatible with Trusted Execution Environment (TEE). |

7. |

Can I use "Mobile Authentication" and "Security Device" at the same time? Yes, you can keep both "Mobile Authentication" and "Security Device". The Security Device will not be terminated after the Mobile Authentication is successfully activated. You can choose "Mobile Authentication" or "Security Device" as your login verification. |

8. |

What happens if I want to stop using my Mobile Authentication activated mobile device? Before you discard your mobile device, you'll need to deactivate your Mobile Authentication, which you can do via the Securities Mobile App or Internet Banking. - Login Securities Mobile App > Mobile Authentication > Deactivate Mobile Authentication, and follow the instructions to suspend your "Mobile Authentication". - Login Internet Banking > My Settings > Mobile Authentication > Deactivate Mobile Authentication, and follow the instructions to deactivate your "Mobile Authentication". - If your mobile device is lost or stolen, you may also contact Customer Service Hotline (852) 223 95559 or visit our outlets. If you have got a new mobile device, you can switch your Mobile Authentication from the old device to the new one. Download the BOCOM(HK) Securities Mobile App on your new mobile device and select "Reactivate Mobile Authentication" from "Mobile Authentication" menu, and follow the instructions to reactivate your Mobile Authentication and Biometric Authentication |

9. |

What happens if my Mobile Authentication activated device is lost or stolen? You can deactivate your Mobile Authentication via Securities Mobile App or Internet Banking. -Login Securities Mobile App > Mobile Authentication > Deactivate Mobile Authentication, and follow the instructions to suspend your "Mobile Authentication". - Login Internet Banking > My Settings > Mobile Authentication > Deactivate Mobile Authentication, and follow the instructions to deactivate your "Mobile Authentication". - You may also contact Customer Service Hotline (852) 223 95559 or visit our outlets. If you have got a new mobile device, you can switch your Mobile Authentication from the old device to the new one. Download the BOCOM(HK) Securities Mobile App on your new mobile device and select "Reactivate Mobile Authentication" from "Mobile Authentication" menu, and follow the instructions to reactivate your Mobile Authentication and Biometric Authentication. |

10. |

What should I do if I have changed the SIM card or mobile phone number on my Mobile Authentication activated mobile device? Since Mobile Security Key is tied to your mobile device instead of your SIM card. No special arrangement is needed after you have changed the SIM card or mobile phone number on your Mobile Authentication activated device. If you have changed your mobile phone number, please update the bank record by visiting our outlets ASAP. |

11. |

Why do I have to set up a Mobile Authentication password? To help prevent anyone else from generating a security code or access your Securities Mobile App service using your mobile device, you will be asked to set up a password for your Mobile Authentication. Do not use your name, date of birth, HKID/passport number, telephone, lucky number, other easy-to-guess numbers or words, or the same password that you have used for accessing other websites and channels (e.g. ATM, Phone Banking, Internet Banking) as your Mobile Authentication Password. |

12. |

What if I forgot my Mobile Authentication password? You can reset the password by “Reactivate Mobile Authentication”function. Simply click "Forgot password" link on the log on page. Please note that you need to have a valid and up-to-date mobile phone number in our records in order to reset your Mobile Authentication password. |

13. |

Can I change my Mobile Authentication password in the future? Yes, if you would like to change your Mobile Authentication password, upon successful log on to the BOCOM (HK) Securities Mobile App Services, select "Mobile Authentication" and then select "Change Mobile Authentication Password" from the menu. |

14. |

Do I have to use my Mobile Authentication password every time I log on to BOCOM(HK) Securities Mobile App Service? Yes, you have to use your Mobile Authentication password when you are logging on to the Securities Mobile App services on a Mobile Authentication activated device. You no longer need your username and password after you have activated your Mobile Authentication while you still need to input certain personal credentials for logging on to Personal Internet Banking. |

15. |

Can others use my Mobile Authentication activated device to log on to their Securities Mobile App? Mobile Authentication is activated on your personal device and only you can access your accounts through a Mobile Authentication activated device. Other users cannot log on to their Securities Mobile App using your Mobile Authentication activated device. |

16. |

Can I use someone else's device as my Mobile Security Key if I don't have my own device with me? The Mobile Authentication is tied to your personal device. We strongly recommended that you should only register Mobile Authentication on your own device that you commonly use. |

17. |

I have activated Mobile Authentication on a jailbroken/rooted device earlier, but I could no longer access the mobile app anymore, what should I do? Since your device is jailbroken/rooted, your device may be less secure and may lead to fraudulent transactions. For security reasons and to protect your interest, you will not be allowed to use our app. In order to continue using our Securities Mobile App services, please deactivate your pervious Mobile Authentication via Internet Banking or contact our customer service hotline, you may also reactivate Mobile Authentication on another non-jailbroken/rooted device. |

"Touch ID/Fingerprint Authentication" Frequently Asked Questions and Answers

1. |

|

2. |

Which devices is Touch ID/Fingerprint available on? iOS Touch ID : Available on Apple iPhone 5s or later models that support fingerprint identity sensor. Android Fingerprint Authentication : Available on Android phones with Android OS version 8.0 or later versions AND compatible with Trusted Execution Environment (TEE). |

3. |

Is Touch ID/ Fingerprint Authentication safe? You can log on to BOCOM(HK) Securities Mobile App with Touch ID/ Fingerprint Authentication on the Mobile Authentication activated device only. Only fingerprints stored on your device can be used to access the Securities Mobile App services. Your fingerprints data will not be stored in the BOCOM(HK) Securities Mobile App or kept anywhere within our bank. You can enable or disable Touch ID/ Fingerprint Authentication anytime in the "Biometic Authentication" under "Mobile Authentication" menu using your Mobile Authentication password. |

4. |

How can I set up my Touch ID for the BOCOM(HK) Securities Mobile App? You can activate Touch ID/ Fingerprint Authentication immediately after you activate Mobile Authentication. You can also enable Touch ID/ Fingerprint Authentication later in the "Biometric Authentication" function under "Mobile Authentication" menu using your Mobile Authentication password, once you have logged on to the BOCOM(HK) Securities Mobile App Services. |

5. |

What happens if I change my Touch ID/ Fingerprint Authentication settings? If you change your fingerprint records on your device or change your Mobile Authentication password, you will need to activate Touch ID again the next time you log onto the BOCOM (HK) Securities Mobile App Service. |

6. |

If my fingerprint is not recognised, can I still log on to my account using my Mobile Authentication password? Yes. Your Mobile Authentication password is always available and you can always switch between using Touch ID/ Fingerprint Authentication and your Mobile Authentication password. |

7. |

Can someone else log on to the BOCOM (HK) Securities Mobile App services if their fingerprint is stored on my device? When you enable Touch ID/ Fingerprint Authentication services in the BOCOM (HK) Securities Mobile App services, any fingerprints stored on your device can be used for Mobile Authentication or access Securities Mobile App services. For security reasons, it is strongly recommended that you only store your fingerprint on your device and use it to enable Touch ID/ Fingerprint Authentication for the Securities Mobile App services. This is to protect not just your BOCOM(HK) account but the rest of your personal details in your device. |

8. |

How can I disable Touch ID/ Fingerprint Authentication in the BOCOM(HK) Securities Mobile App? You can enable or disable Touch ID/ Fingerprint Authentication anytime in the “Biometric Authentication” under “Mobile Authentication” menu using your Mobile Authentication password. |

9. |

What if my Touch ID/Fingerprint Authentication enabled device is lost or stolen? You can deactivate your Mobile Authentication via Securities Mobile App or Internet Banking. -Login Securities Mobile App > Mobile Authentication > Deactivate Mobile Authentication, and follow the instructions to suspend your "Mobile Authentication". - Login Internet Banking > My Settings > Mobile Authentication > Deactivate Mobile Authentication, and follow the instructions to deactivate your "Mobile Authentication". - You may also contact Customer Service Hotline (852) 223 95559 or visit our outlets. If you have got a new mobile device, you can switch your Mobile Authentication from the old device to the new one. Download the BOCOM(HK) Securities Mobile App on your new mobile device and select "Reactivate Mobile Authentication" from "Mobile Authentication" menu, and follow the instructions to reactivate your Mobile Authentication and Biometric Authentication. |

10. |

Where will my fingerprints be stored? Your fingerprints will not be stored in the BOCOM (HK) Mobile app or kept anywhere within BOCOM (HK). You can use the fingerprints stored on your device to access Mobile Authentication or Securities Mobile App Services. |

"Face ID" Frequently Asked Questions and Answers

1. |

Face ID acts as an easy alternative to using Mobile password for iOS device users. It offers a simple, secure and faster way to access BOCOM(HK) Securities Mobile App service or generate secure code using your facial map stored on your Apple iPhone X or newer models. |

2. |

Which devices is Face ID available on? Face ID is currently available on Apple iPhone X or new models and operates on iOS 12.2 or above. |

3. |

Should I enable "Face ID " if my siblings and I look alike or I am an adolescent? You must not use Biometric Authentication if you have reasonable belief that other people may share identical or very similar biometric credential(s) of you or your biometric credential(s) can be easily compromised. For instance, you must not use facial recognition for authentication purpose if you have identical twin or triplet sibling(s). You must not use Biometric Authentication if the relevant biometric credential(s) of you are or will be undergoing rapid development or change. For instance, you must not use facial recognition for authentication purpose if you are an adolescent with facial features undergoing rapid development. |

4. |

Is Face ID safe? You can only log on to the BOCOM(HK) Securities Mobile App app with Face ID on a device activated by your Mobile Authentication. Only the facial map stored on your device can be used to access the app. Your facial map data will not be stored in the BOCOM(HK) Securities Mobile App or kept anywhere within BOCOM(HK). You can enable or disable Face ID anytime in the “Biometic Authentication” function under “Mobile Authentication”menu using your Mobile Authentication password. Please note that the probability of a false match using Face ID may be dependent on certain circumstances, e.g. twins or siblings that look alike, or if you’re an adolescent, and have disabled the ""Require Attention for Face ID"" function in your device settings. Please read the Terms and Conditions carefully and accept the associated risks and consequences before you enable Face ID. |

5. |

How can I set up my Face ID for the BOCOM(HK) Securities Mobile App? You can activate Face ID immediately after you activate Mobile Authentication. You can also enable Face ID later in the “Biometric Authentication” function under “Mobile Authentication” menu using your Mobile Authentication password, once you have logged on to the BOCOM(HK) Securities Mobile App Services. |

6. |

What happens if I change my Face ID settings? If you change your Face ID records on your device or change your Mobile Authentication password, you will need to activate Face ID again the next time you log onto the BOCOM (HK) Securities Mobile App Service. |

7. |

If my face is not recognised, can I still log on to my account using my Mobile Security Key password? Yes. Your Mobile Authentication password is always available and you can switch between using Face ID and your Mobile Authentication password at any time. |

8. |

Can someone else log on to the BOCOM (HK) Securities Mobile App services if their facial map is stored on my device? When you enable Face ID services in the BOCOM (HK) Securities Mobile App services, any facial map on your device can be used for Mobile Authentication or access Securities Mobile App services. For security reasons, it is strongly recommended that you only store your facial map on your device and use it to enable Face ID for the Securities Mobile App services. This is to protect not just your BOCOM(HK) account but the rest of your personal details in your device. |

9. |

How can I disable Face ID in the BOCOM(HK) Securities Mobile App? You can enable or disable Face ID anytime in the “Biometric Authentication” under “Mobile Authentication”menu using your Mobile Authentication password. |

10. |

What if my Face ID enabled device is lost or stolen? You can deactivate your Mobile Authentication via Securities Mobile App or Internet Banking. -Login Securities Mobile App > Mobile Authentication > Deactivate Mobile Authentication, and follow the instructions to suspend your ""Mobile Authentication"". - Login Internet Banking > My Settings > Mobile Authentication > Deactivate Mobile Authentication, and follow the instructions to deactivate your ""Mobile Authentication"". - You may also contact Customer Service Hotline (852) 223 95559 or visit our outlets. If you have got a new mobile device, you can switch your Mobile Authentication from the old device to the new one. Download the BOCOM(HK) Securities Mobile App on your new mobile device and select ""Reactivate Mobile Authentication"" from ""Mobile Authentication"" menu, and follow the instructions to reactivate your Mobile Authentication and Biometric Authentication. |

11. |

Where will my facial map be stored? Your facial map will not be stored in the BOCOM (HK) Mobile app or kept anywhere within BOCOM (HK). You can use the facial map stored on your device to access Mobile Authentication or Securities Mobile App Services. |

12. |

If I selected "Don't allow" when asked whether I wanted to set up Face ID for the BOCOM(HK) Securities Mobile App, can I enable it again later? Yes. You should first turn on Face ID access for the BOCOM(HK) Securities Mobile App under the device settings "Face ID & Passcode -> Other Apps". You can then log on to the app with your Mobile Authentication password to enable Face ID |

“Reply Corporate Actions” Frequently Asked Questions and Answers

1. |

|

2. |

Why the Corporate Action that I am entitled did not show in the "Corporate Actions" page? The entitlement details will not be shown in the Corporate actions page when : - Client’s initial entitled quantity of rights has already been sold and settled; - The quantity of rights subsequently purchased by client in the market on the current day; - None option provided ( E.g. Cash Dividend) or the options are complicated Clients can sign and return the selection form to us* or call our Securities Services Hotline at 2913 3833 to give the corresponding instructions. (*Any subscriptions by mail or by facsimile will not be accepted) |

3. |

Can I submit a instruction via Internet/ Securities Mobile Application in advance of an expected corporate action? No. You can only submit corporate action instructions via Internet/ Securities Mobile Application after we have issued electronic or paper advice informing you of the details of a corporate action. |

4. |

What is the meaning of the status in Corporate Action ? - Click “Enquire” for the details of specific corporate action, the status will change from “Unread” to “Read” afterwards. - Click “Reply” to give your corporate action instruction. The status will change from “Unread” to “Replied” once the registration is completed. - Click “Amend”or“Cancel”to amend/cancel the“Replied” instruction. The amendment or cancellation are applicable before the "End Date". - “Closed”mean the corporate action event has passed the submission deadline and client is not allowed to input/change instruction. |

5. |

Why historical Corporate Action Events are not showing on Internet/ Securities Mobile Application? The historical Corporate Action Events will be removed which passed the Last Reply Date/Time for 10 calendar days. |

"Internet / Securities Mobile Application Portfolio Instant Gain and Loss Display Function" Frequently Asked Questions and Answers

1. |

|

2. |

What is Instant Gain and Loss Calculation? If customers process securities transaction, the "Reference Average Purchase Price" will be automatically updated according to all your buy orders on or after the effective date. The calculation will exclude transaction charge and the third party charges, such as brokerage fee, stamp duty, other levies and taxes, etc. The “Reference Average Purchase Price” will not be affected by sell orders. While the sell order will update the number of shares you are holding only. If there are corporate actions taken place for the securities held, the calculation will include but not limited to bonus shares, spin-off mergers or rights issues, etc., the "Reference Average Purchase Price" will be adjusted proportionally. Cash dividends, charges of corporate actions, etc., however, will not be included in the calculation. |

3. |

Which devices is the Internet / Securities Mobile Application Portfolio Instant Gain and Loss Display Function available on and any charges for this function? The Internet / Securities Mobile Application Portfolio Instant Gain and Loss Display Function is currently available on BOCOM(HK) Internet Banking and BOCOM(HK) Securities Mobile Application platform, also it is free of charge for using Portfolio Instant Gain and Loss Display Function. |

4. |

Which stock market is available for the Internet / Securities Mobile Application Portfolio Instant Gain and Loss Display Function? The Internet / Securities Mobile Application Portfolio Instant Gain and Loss Display Function is only applicable to HK Stocks, the stock price for such calculation is delayed by at least 15 minutes. The China Connect Securities and other overseas securities are not applicable. |

To know more about the details of the Internet / Securities Mobile Application Portfolio Instant Gain and Loss Display Function, please click here.

"Securities Mobile Application AI Stock Filter Function" Frequently Asked Questions and Answers

1. |

|

2. |

How to use the AI Stock Filter Function? The customers can enter the function by clicking the "AI Stock Filter" icon on the homepage of the securities mobile application. After reading and agreeing to the relevant terms, customers can start using it. The customers can use preset strategies with objective criteria to screen the stocks in the "Popular" field. Or the customers can use various criteria to set up their own stock selection strategies in the "Search" field (up to 10 criteria can be selected). For the customers who log in the application already, they can use their own stock selection strategies saved earlier in the "My" field. All the stocks screened by the strategies will be shown in the "Search Results" page. The customers can either click "BUY/SELL" buttons for securities trading, or "STOCK QUOTE" to view detailed information of individual stocks. |

3. |

|

4. |

|

The above information is for reference only. For further details, please visit any of our outlets or call our customer service hotline.

Risk Disclosure Statement

The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

Remarks

Please note that the type of transaction mentioned above only applies to the purchase / sale of Hong Kong Stock under HKEx.

Customer Service Hotline: 223 95559

Customer Service Hotline: 223 95559

Please visit any of

Please visit any of