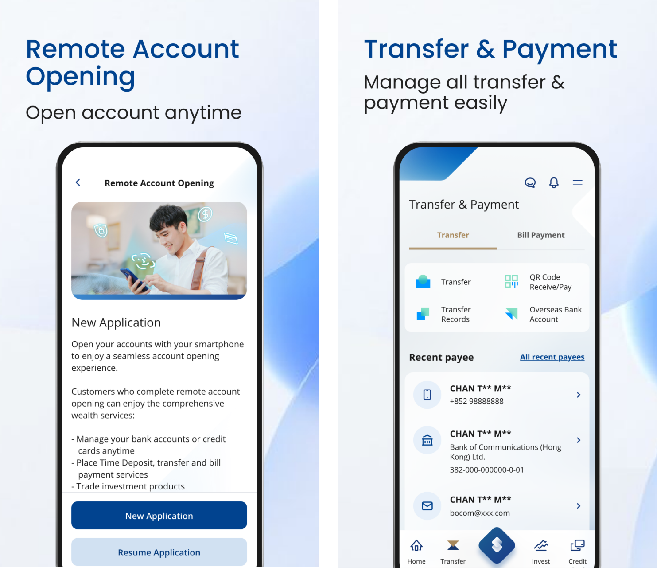

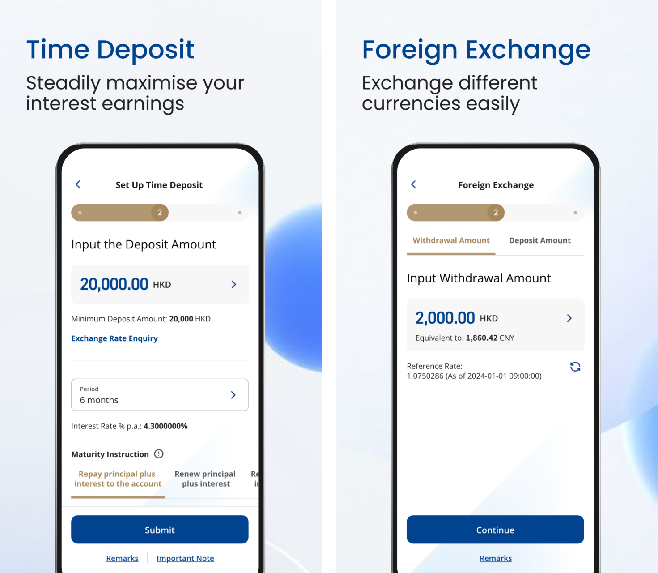

The brand new “BOCOM(HK) Mobile Banking” App has been launched. Enjoy your new mobile banking experience with personalized features via new interface!

Download “BOCOM(HK) Mobile Banking” App

Featured services

The Apple logo is a trademark of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Risk Disclosure Statement:

The above information is for reference only and is neither a recommendation, an offer, nor a solicitation for any investment product or service. Investment involves risks. Investors should note that all investment involves risks. Prices of investment products may go up as well as down and may even become valueless. Past performance is not an indication of future performance. Investors should read carefully and understand the offering documents and the relevant Risk Disclosure Statement before making any investment decision. You should also take reasonable steps to assess the appropriateness of the transaction in light of your own risk, financial situation, objectives, investment tenor and other circumstances. The investment decision is yours, if you are in doubt, you should seek independent professional advice. The products are not protected deposits and are not protected by the Deposit Protection Scheme in Hong Kong. The above information is prepared by Bank of Communications (Hong Kong) Limited and have not been reviewed by any regulatory authority in Hong Kong.

Securities Trading Risk Disclosure Statement:

The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

Investment Funds Risk Disclosure Statement:

This is an investment product and some Investment Fund may involve derivatives or invest in emerging markets. Investments involve different risks such as market, concentration, currency, volatility, liquidity, regulatory and political risks. Funds invested in a limited number of markets, sectors or companies will be subject to higher risk and are more sensitive to price movements. Funds invested in emerging markets are subject to a higher risk as they involve a higher degree of volatility than funds invested in developed markets. This Risk Disclosure Statement may not disclose all risks involved, and different products are subject to different risks. Investors should read the relevant fund's offering documents in detail, including the full text of the risk factors stated therein, before making any investment decision.

Precious Metals and FX Margin Trading Risk Disclosure Statement:

The risk of loss in leveraged precious metals and foreign exchange trading can be substantial. You may sustain losses in excess of your initial margin funds. Placing contingent orders, such as "stop-loss" or "stop-limit" orders, will not necessarily limit losses to the intended amounts. Market conditions may make it impossible to execute such orders. You may be called upon at short notice to deposit additional margin funds. If the required funds are not provided within the prescribed time, your position may be liquidated. You will remain liable for any resulting deficit in your account. You should therefore carefully consider whether such trading is suitable in light of your own financial position and investment objectives.

Bond Risk Disclosure Statement:

Investor bears the credit risk of the issuer and the guarantor (if any) and has no recourse to the Bank. Before entering into any transaction, you are advised to read carefully the Offering Circular, to understand the possible risks and the product features. You should also take reasonable steps to assess the risks and appropriateness of the transaction in light of your own risk, financial situation, objectives, investment tenor and circumstances. The prices of bonds and their returns may move up or down due to the market conditions. Bond investment involves risk, including the possible loss of the principal amount invested. An investment in bonds is not equivalent to a time deposit and should not be taken to replace a time deposit.

Insurance Risk Disclosure Statement:

The insurance plan is a product of the corresponding underwriting insurance company, but not the Bank. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Bank and the customer out of the selling process or processing of the related transaction, the Bank is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the product should be resolved directly between the corresponding underwriting insurance company and the customer.

RMB Currency Risk Disclosure Statement:

RMB is subject to exchange rate risk and is currently not freely convertible. Conversion of RMB or provision of RMB services through banks in Hong Kong is subject to relevant RMB policies, other restriction and regulatory requirements in Hong Kong. No prior notice will be given for any changes which may be made from time to time.

Foreign Exchange Risk Disclosure Statement:

Foreign currency investments are subject to exchange rate fluctuations which may involve risks. The fluctuation in the exchange rate of foreign currency may make a gain or loss in the event that customer converts the foreign currency into Hong Kong dollar or other foreign currencies.

MPF Risk Disclosure Statement:

Bank of Communications (Hong Kong) Limited (the “Bank”) is a registered principal intermediary in providing MPF services. The relevant MPF scheme is a product of Bank of Communications Trustee Limited but not the Bank; and in respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Bank and the customer out of the selling process or processing of the related transaction, the Bank is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute on the contractual terms of the product should be resolved between Bank of Communications Trustee Limited and the customer directly.

To borrow or not to borrow? Borrow only if you can repay!

Customer Service Hotline: 223 95559

Customer Service Hotline: 223 95559

Please visit any of

Please visit any of